Customs Clearance for Reefer Containers from China: Documents, Compliance & Costs Explained

When you're moving perishable cargo across borders, customs clearance isn't just about tariffs and paperwork. It's about time, temperature integrity, and regulatory precision working together in a narrow window. Your cargo counts down from the moment it's loaded, every hour of delay costs you shelf life, and unlike dry containers, your reefer needs continuous power, monitoring, and rapid movement through checkpoints.

The complexity multiplies when you factor in health certificates, phytosanitary inspections, pre-arrival notifications, and destination-specific licensing requirements. This guide walks you through the complete customs clearance process for reefer containers from China, covering documents, compliance steps, and cost structures.

Just getting started with international cold chain? Explore our ultimate guide to reefer container shipping from China.

Understanding Reefer Cargo Types and Temperature Requirements

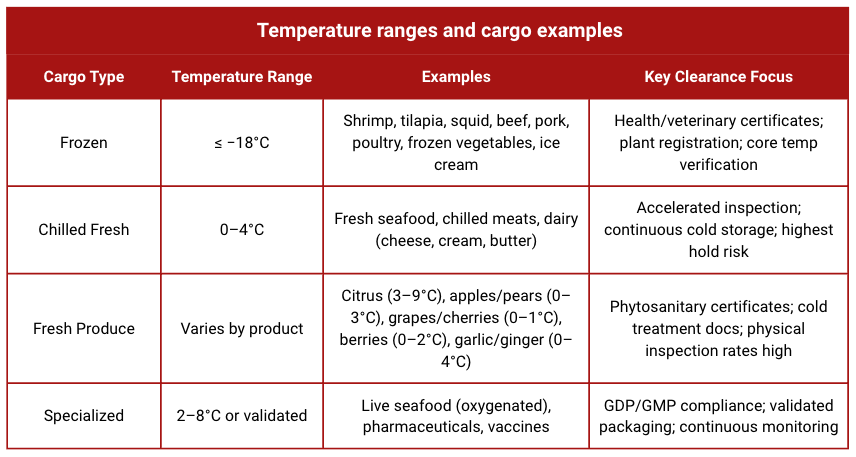

Your clearance complexity depends on what you're shipping. Different cargo types face different regulatory scrutiny and temperature tolerances.

Frozen cargo offers longer shelf life during delays but faces stricter origin controls. Chilled cargo has tight time windows and premium processing fees. Fresh produce requires phytosanitary compliance and ventilation management.

Full Document Checklist for Reefer Customs Clearance

Exporter-Side Documents (China Origin)

Commercial Invoice – HS codes, declared value, Incoterm, product description, quantity, processing method, production date/batch code

Packing List – Container number, seal, gross/net weight, carton count, stowage pattern

Bill of Lading (B/L) – Shipper, consignee, ports, container type, temperature set-point

China Export Declaration – Filed through Single Window system; must match invoice and packing list

Health/Veterinary Certificate – For animal products (meat, seafood, dairy); issued by GACC; certifies plant registration and product safety

Phytosanitary Certificate – For plant products; issued by GACC; proves pest-free status

Certificate of Origin – RCEP, Form E (ASEAN-China FTA), or standard; enables preferential tariffs

Pre-Trip Inspection (PTI) Record – Proves reefer unit tested before loading; critical for dispute resolution

Temperature Data Logger Report – Electronic log tracking temperature throughout transit; expected by customs and insurers

Cold Treatment Certificate – Required for certain fruits (citrus, grapes) to specific markets

Importer-Side Documents (Destination Country)

Import License/Permit – Many countries restrict food imports to licensed entities covering specific product categories

Pre-Arrival Notification Filings – Varies by destination (detailed in regional compliance section)

Laboratory Certificates – Residue testing, microbiological analysis, or nutritional verification as required

Labeling Compliance Documentation – Ingredient lists, allergen warnings, nutrition facts in destination language/format

Insurance Certificate – Marine cargo insurance covering temperature deviation losses

Purchase Order/Sales Contract – Transaction verification for customs

China Export-Side Compliance: What Happens Before Your Container Leaves

Exporter Registration and Plant Approval

For animal products (meat, seafood, dairy), the Chinese processing facility must be GACC-registered and approved for export to your destination market. Check official establishment lists before signing contracts.

CIQ/GACC Inspection and Export Declaration

High-risk products undergo origin inspection. GACC verifies plant conditions, product samples for residues, temperature records, batch traceability, and container loading. Inspections take 1–3 business days.

Every export requires electronic customs declaration through China's Single Window. The declaration includes accurate HS code, FOB value, quantity, destination, and transport information. Shipping lines require proof of export clearance before releasing the B/L.

PTI and Container Loading

Conduct Pre-Trip Inspection before loading: verify compressor function, temperature probe accuracy, airflow patterns, stable set-point, and no contamination. Install a calibrated temperature data logger positioned per manufacturer instructions.

Document your set-point, ventilation settings, and loading pattern. Frozen cargo typically runs at −18°C with minimal ventilation; fresh produce requires specific vent rates and humidity control.

Incoterm Responsibilities

FOB/CFR/CIF: Seller manages China export clearance

EXW: Buyer arranges export clearance (often via Chinese forwarder)

FCA: Depends on named place

Clarify responsibilities in writing before production.

Destination Import Compliance: Regional Requirements

Once your reefer container arrives, new compliance rules take effect. While all destinations share a common inspection framework, each region adds unique requirements.

Universal Import Process (All Markets)

Regardless of destination, expect these three core steps:

Pre-Registration/Licensing – Importer must hold valid licenses covering the product category; processing plants often require destination-market approval before first shipment

Port Inspection – Documentary review, identity checks, and physical examination (frequency varies by product risk level and market)

Laboratory Testing – Sample analysis for residues, microbiological parameters, or quality verification (routine or risk-based depending on jurisdiction)

Below are the unique requirements each market adds to this universal framework.

United States

Pre-Arrival Filing: ISF 10+2 (24 hours before loading at Chinese port); FDA Prior Notice (before vessel arrival)

Primary Authorities: FDA (Food and Drug Administration), USDA FSIS (meat/poultry), CBP (Customs and Border Protection)

Unique Requirements: FSIS plant approval mandatory for meat and poultry exports; cold treatment verification required for certain fruits (citrus, grapes, lychee); antidumping and countervailing duties (ADD/CVD) commonly applied to frozen seafood

Timeline: ISF must be filed 24 hours pre-loading; Prior Notice before arrival

European Union

Pre-Arrival Filing: TRACES NT system (CHED-P for products of animal origin, minimum 24 hours before arrival)

Primary Authorities: EU Commission, Member State Border Control Posts (BCPs)

Unique Requirements: Entry only through designated BCPs with veterinary inspection capacity; RASFF (Rapid Alert System for Food and Feed) alert history triggers increased scrutiny; all POAO undergo documentary, identity, and physical checks

Timeline: CHED-P notification at least 24 hours pre-arrival

Middle East (UAE, Saudi Arabia)

Pre-Arrival Filing: Embassy-legalized certificates required 1–2 weeks before shipment

Primary Authorities: SFDA (Saudi Food and Drug Authority), MOCCAE (UAE Ministry of Climate Change and Environment)

Unique Requirements: Halal certification mandatory for meat, poultry, and many processed foods; product registration with SFDA required before import to Saudi Arabia; health and phytosanitary certificates must be legalized through Chinese Ministry of Foreign Affairs and destination country embassy

Timeline: Certificate legalization takes 1–2 weeks; product registration varies by category

Latin America (Brazil, Mexico, Chile)

Pre-Arrival Filing: Dichave/import license (Brazil, before shipment); Avisos permits (Mexico, before arrival); SAG authorization (Chile, advance approval)

Primary Authorities: MAPA (Brazil Ministry of Agriculture), SENASICA (Mexico), SAG (Chile Agricultural and Livestock Service)

Unique Requirements: Plant-specific approval lists maintained by Brazil MAPA and Chile SAG, only approved Chinese facilities can export; Mexico conducts physical inspections at 40–60% rate; shelf-life validation against transit time commonly verified; some countries require Spanish-language labels

Timeline: Import permits typically require 1–4 weeks advance application

India

Pre-Arrival Filing: Import declaration with IEC (Import Export Code) and FSSAI license covering product category

Primary Authorities: FSSAI (Food Safety and Standards Authority of India), Plant Quarantine

Unique Requirements: Embassy endorsement often required for health certificates from China; frequent laboratory testing even when origin certificates are provided; FSSAI product approval and importer registration must be in place before first shipment; additional state-level registrations may apply

Timeline: FSSAI registration is ongoing requirement; standard entry procedures at port

Indonesia

Pre-Arrival Filing: BPOM product registration (requires 3–6 months for new products)

Primary Authorities: BPOM (National Agency of Drug and Food Control), Agricultural Quarantine Agency

Unique Requirements: Mandatory product registration with BPOM before first import, plan 3–6 months ahead for new products; health certificates require Indonesian embassy endorsement in China; Halal certification (MUI-recognized) mandatory for meat, poultry, and most processed foods; quarantine inspection at all entry points

Timeline: BPOM registration 3–6 months; quarantine clearance at entry

Cost Breakdown: Where Importers Overpay on Reefer Clearance

Reefer clearance costs extend well beyond customs duties.

Port and Terminal Charges

Plug-In Fees: $50–150/day for electricity and temperature monitoring

Cold Storage: $300–800/container/day during inspection holds

Reefer Inspection Fees: $200–500/inspection due to handling complexity

Demurrage and Detention: $150–300/day (reefer); starts after 5–7 free days

Customs and Compliance Costs

Customs Duties: Varies by HS code; seafood often 0–6%; produce varies widely; processed foods 10–20%. Add VAT/GST in applicable markets.

Brokerage Fees: $150–400/entry; premium for expedited reefer processing

Health/Phytosanitary Inspection Fees: Government charges for physical inspections and lab testing

Certificate Fees: $50–200/document from Chinese authorities

HS Code Classification Impact on Costs

Accurate HS classification directly affects duty rates and compliance requirements. For example:

Frozen Shrimp: HS 0306.17 typically carries lower duty but faces antidumping duties in US market

Fresh Citrus: HS 0805.10–0805.50 ranges trigger different phytosanitary requirements and seasonal quotas

Frozen Vegetables: HS 0710.xx generally faces lower scrutiny but requires accurate variety classification

Dairy Products: HS 0406.xx (cheese) faces import quotas and licensing in many markets

Misclassification leads to re-liquidation penalties, delayed clearance, or rejected entries. Invest in expert classification before your first shipment.

Where Importers Overpay

Inadequate Free-Time Management: A five-day clearance delay costs $750–1,500 in avoidable demurrage and plug-in fees.

Reactive Compliance: Fixing documentation issues after arrival costs exponentially more than pre-shipment preparation.

Peak Season Premiums: Chinese New Year and year-end periods see 20–30% higher reefer-specific costs due to port congestion.

Real-World Example: Frozen Shrimp Clearance Timeline and Costs

Product: Frozen vannamei shrimp (HS 0306.17.00), 10kg cartons

Route: Zhanjiang, China → Los Angeles, USA

Container: 40HC reefer, 26 pallets, 22,000kg net

Incoterm: CIF Los Angeles

Cost Summary

Customs duty on this particular shrimp classification was $0 under applicable trade conditions; ADD/CVD rates vary by exporter and should be verified for each shipment.

Partnering with Experienced Logistics Providers

Managing reefer clearance from China requires precision, real-time monitoring, and regulatory expertise. When coordinating health certificates, pre-arrival filings, and tight delivery windows, an experienced logistics partner prevents costly disruptions.

At Gerudo Logistics, we specialize in cold-chain shipments from China to global destinations. Our teams handle China export documentation, PTI coordination, temperature monitoring, pre-arrival filings across multiple jurisdictions, and destination customs broker relationships. Contact to discuss your cold-chain logistics needs.

Final Workflow Summary: Importer Use-Case SOP

Pre-Production Phase

Verify exporter registration and plant approval for your destination

Classify products accurately (HS codes) and confirm duty rates

Secure import licenses covering your product categories

Review label compliance for destination market

Pre-Shipment Phase

Order PTI and install calibrated temperature data logger

Confirm all certificates (health/veterinary/phytosanitary) are issued correctly

Document set-point, ventilation settings, and loading pattern

File pre-arrival notifications (ISF, FDA Prior Notice, TRACES, etc.) on time

Transit and Arrival Phase

Monitor temperature remotely if logger connectivity available

Prepare entry documents for customs broker before B/L release

Confirm container plug-in immediately upon discharge

Respond immediately to inspection requests

Retrieve data logger report for customs verification

Arrange drayage within free time to avoid demurrage

Post-Clearance Phase

Archive all documentation for audit trail or insurance claims

Review performance metrics (transit time, clearance speed, cost actuals)

Update SOPs based on lessons learned

Frequently Asked Questions for Reefer Customs Clearance

What core documents do I need for a reefer export from China?

Commercial invoice, packing list, bill of lading, China export declaration, health/veterinary certificate (animal products) or phytosanitary certificate (plant products), certificate of origin, PTI record, and temperature logger report. Add destination-specific pre-notifications.

Which products require a health certificate versus a phytosanitary certificate?

Animal-origin products (meat, seafood, dairy) require health or veterinary certificates. Plant products (fruit, vegetables) require phytosanitary certificates. Some fruits need cold-treatment certificates for certain markets.

What is PTI and why does it matter?

PTI (Pre-Trip Inspection) verifies the reefer container's refrigeration unit, sensors, and controls function correctly before loading. It prevents in-transit failures and provides critical evidence for disputes or insurance claims.

Do I need a temperature data logger?

While not always legally mandated, data loggers are strongly expected by buyers, customs authorities, and insurers. Temperature records are often decisive in resolving quality questions or claims.

What pre-arrival filings are common at destination?

US requires ISF 10+2 and FDA Prior Notice. EU needs TRACES NT (CHED-P for animal products). Middle Eastern countries often require embassy-legalized certificates. Latin America demands advance permits. India and Indonesia require product registration and quarantine approvals.

What causes border holds for reefer shipments?

Missing or incorrect certificates, late pre-notifications, HS misclassification, non-compliant labels, and unexplained temperature excursions trigger most holds.

How should I set temperature, ventilation, and airflow?

Follow commodity guidelines: −18°C for frozen products, 0–4°C for chilled items, varied ranges for fresh produce. Document set-point, ventilation settings, and loading pattern. Incorrect settings damage cargo and raise compliance questions.

Conclusion

Customs clearance for reefer containers from China demands accuracy and timing. The key is preparation: verify registrations before production, gather certificates before loading, file notifications before arrival, and monitor temperature continuously.

Whether importing frozen seafood, fresh produce, or chilled dairy, the principles remain constant: understand your cargo, know the regulations, execute with precision, and maintain temperature integrity throughout.

Ready to streamline your reefer imports from China? Contact Gerudo Logistics for expert cold-chain logistics support tailored to your products and destinations.