Shipping to Riyadh via Dammam: How to Avoid Rail Overweight Fine (2026)

The $400 Penalty: Why Dammam to Riyadh Shipping Costs More Than Expected

Riyadh is the economic heart of Saudi Arabia, commanding over 50% of the Kingdom's retail and manufacturing activity. For importers targeting this market, the city's landlocked position creates a logistics challenge that many underestimate until it appears as an unexpected line item on their invoice.

The penalty is specific: $400 USD per container. The trigger is technical: exceeding a 24-ton weight threshold during rail transit from Dammam Port to Riyadh. The impact extends beyond the fine itself, cascading into delays, demurrage charges, and disrupted supply chains.

This is not a negotiable customs duty or a variable port fee. This is a structural limitation of the Saudi Railway Company (SAR) infrastructure, enforced automatically when containers are transferred from ocean vessels to rail wagons. Importers shipping to Riyadh via Dammam face this constraint on every shipment, yet many discover it only after their cargo has been flagged at the port.

This guide explains the technical weight limits that govern Dammam to Riyadh shipping, breaks down the true cost of violations, and provides three strategic approaches to protect your profit margins while ensuring on-time delivery to Saudi Arabia's capital.

Dammam Port to Riyadh Dry Port: How the SAR Rail Route Works

Choosing Between Jeddah and Dammam for Riyadh Shipments

Saudi Arabia offers two primary entry points for cargo destined to Riyadh: Jeddah on the Red Sea coast and Dammam on the Arabian Gulf. For shipments originating from Asia, the UAE, and East Africa, Dammam Port (officially King Abdulaziz Port) serves as the dominant gateway. The port handles over 60% of containerized cargo bound for central Saudi Arabia.

Jeddah remains the preferred entry for cargo from Europe, North Africa, and certain Mediterranean origins. However, Dammam's proximity to Asia makes it the natural choice for Chinese manufacturing exports, Indian industrial goods, and intra-Gulf trade.

SAR Railway Connection from Dammam to Riyadh

Once containers are discharged at Dammam Port, importers face a routing decision. The destination can be specified as either "Dammam Port" for local clearance or "Riyadh Dry Port" (RDP) for inland clearance. Most shippers choose the latter.

The Riyadh Dry Port operates as an inland customs clearance facility located within the capital. Containers booked to RDP are transferred from the port terminal to a dedicated rail loading area, placed on Saudi Railway Company (SAR) wagons, and moved approximately 400 kilometers inland to the dry port facility.

This rail connection is operated exclusively by SAR, which manages both passenger and freight services across the Kingdom. The railway infrastructure was built to modern specifications, but it operates under strict weight restrictions that differ significantly from ocean carrier standards.

Why Shippers Choose Rail Over Road Transport

Importers prefer the rail option for several operational reasons. Customs clearance at Riyadh Dry Port consolidates cargo from multiple shippers into a single facility with centralized inspection and documentation processing. This reduces the need to maintain customs agents at multiple locations.

Road congestion between Dammam and Riyadh can add unpredictable delays to truck transport, particularly during peak shipping seasons or religious holidays. Rail schedules operate with greater consistency, providing more reliable arrival times for importers managing just-in-time inventory.

The rail tariff is typically lower than dedicated truck transport for standard containers, making it the default choice for cost-conscious shippers. However, this cost advantage disappears quickly when weight violations trigger penalties and delays.

The 24-Ton SAR Railway Weight Limit Explained

Ocean Freight vs Rail Weight Standards

Ocean carriers operate under International Maritime Organization (IMO) standards that permit 20-foot containers to be loaded up to 28 metric tons gross weight. Shipping lines build vessels and design stowage plans based on these limits. Container ships regularly carry boxes at or near this maximum weight without structural concerns.

Rail infrastructure operates under different engineering constraints. SAR rail wagons must distribute container weight across multiple axles while maintaining track integrity and safe operating speeds. The railway's maximum permissible axle load is lower than what ocean vessels can handle, creating a mismatch between what arrives by sea and what can continue by rail.

This discrepancy appears in railways worldwide, which impose stricter weight limits than ocean freight. The specific threshold in Dammam creates a common trap for importers who assume that a container cleared for ocean transport will automatically transfer to rail without issue.

How to Calculate the 24-Ton Gross Weight Limit

The critical threshold for 20-foot containers on the SAR railway is 24 metric tons gross weight. Gross weight is calculated as:

Cargo Weight + Container Tare Weight = Gross Weight

Container tare weight (the weight of the empty container itself) varies by manufacturer and container age but typically ranges from 2.2 to 2.3 metric tons for standard 20-foot dry containers. High-cube containers and specialized units may weigh more.

This means that to stay within the 24-ton rail limit, your actual cargo weight must not exceed approximately 21.7 to 21.8 metric tons. Shippers who load containers to 22 tons of cargo, assuming they have a comfortable margin below the 28-ton ocean limit, will exceed the 24-ton rail threshold once tare weight is added.

For 40-foot containers, the railway applies proportionally higher limits based on the increased axle count of the rail wagon. However, the same principle applies: the container must distribute its weight across the wagon's axle configuration without exceeding structural limits.

When the $400 Overweight Penalty is Applied

Weight verification occurs during container discharge operations at Dammam Port. Saudi Global Ports (SGP), the terminal operator, uses calibrated weighing systems to measure every container as it is lifted from the vessel by quay cranes.

When a container destined for Riyadh Dry Port registers above 24 metric tons, the terminal's logistics system automatically flags it as non-compliant for rail transfer. The container is moved to a designated holding area rather than proceeding to the rail loading zone.

At this point, the $400 overweight tariff is applied to the shipper's account. This fee is not negotiable and does not vary based on how much the container exceeds the limit. A box that weighs 24.1 tons pays the same penalty as one that weighs 27 tons.

True Cost of Riyadh Rail Overweight Violations: Beyond $400

The Direct $400 Overweight Tariff

The $400 USD overweight penalty is invoiced as a standard tariff by the port or railway operator. This fee appears on your cargo account regardless of whether you choose to proceed with specialized handling or divert to truck transport.

The penalty is separate from any regular rail freight charges you have already paid. It functions as an additional surcharge for handling cargo that requires different equipment or procedures than standard rail operations.

Delays: 3 to 5 Days Waiting for Specialized Equipment

Containers flagged as overweight cannot board regularly scheduled trains. The standard rail service from Dammam to Riyadh operates on fixed departure schedules, typically with daily or semi-daily frequency depending on cargo volume.

Your container must wait for availability of specialized heavy-duty rail wagons designed for higher axle loads. These wagons are less common in the SAR fleet and may not be immediately available at Dammam terminal.

The typical delay ranges from 3 to 5 days, though it can extend longer during peak shipping periods when demand for specialized equipment exceeds supply. During this waiting period, your container remains in port custody, accumulating additional charges.

Cascading Costs: Demurrage, Storage, and Handling Fees

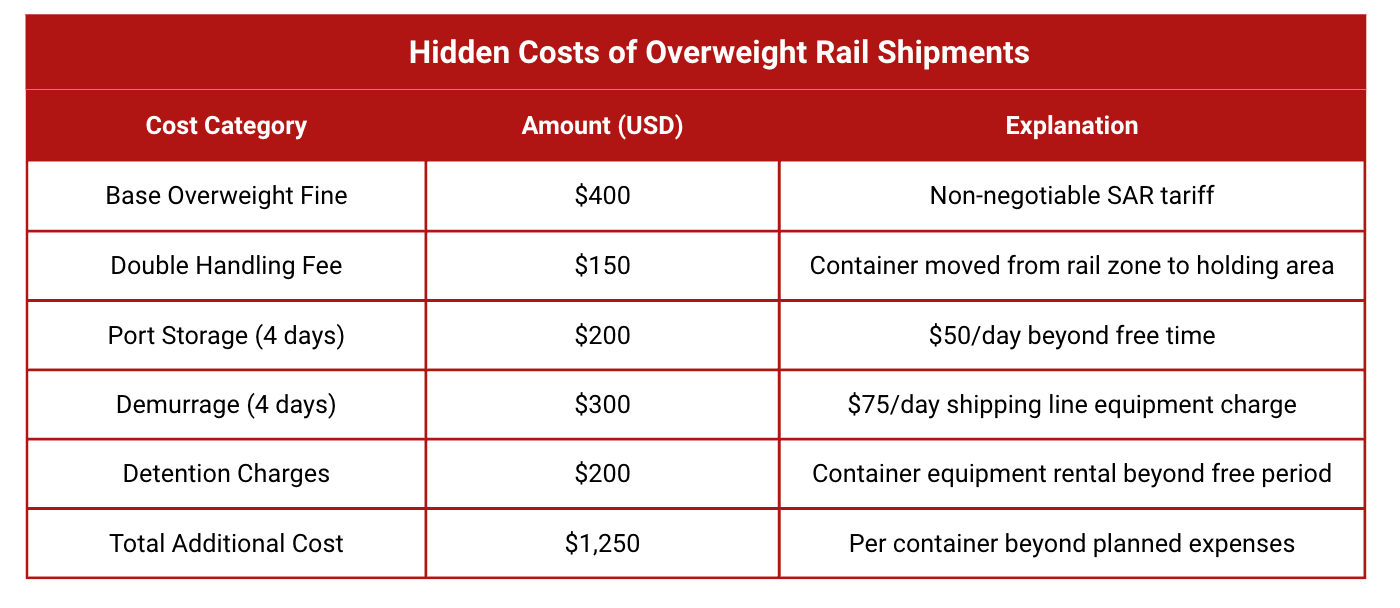

The true cost of an overweight violation extends well beyond the base penalty. Consider this realistic breakdown for a typical 20-foot container:

This calculation assumes only 4 days of delay. If specialized rail equipment takes longer to arrange, or if the delay pushes your clearance into a weekend or holiday period, costs escalate further.

Many importers fail to account for these cascading charges when evaluating the cost difference between rail and truck transport. The apparent savings of rail freight disappear quickly once overweight penalties and delays are factored into the equation.

Supply Chain Disruptions for JIT Manufacturing

For Riyadh-based manufacturers operating on just-in-time inventory systems, a 3 to 5 day delay creates operational disruptions that exceed the financial cost of penalties.

Production lines may shut down waiting for delayed components, making customer delivery commitments impossible to meet. The importer's reputation with end customers suffers when supply chain failures occur repeatedly.

In industries with seasonal demand patterns or contractual delivery deadlines, missing a critical shipping window can result in cancelled orders or penalty clauses that dwarf the cost of logistics fees.

Three Strategies to Avoid Riyadh Rail Weight Penalties

Strategy 1: Enforce 21-Ton Cargo Weight Limit

The most straightforward approach is to enforce strict cargo weight limits during the packing and loading process. By capping your cargo weight at 21 metric tons for 20-foot containers, you ensure that total gross weight remains safely below the 24-ton threshold even with container tare weight added.

This strategy requires clear communication with your suppliers and coordination between all parties involved in the shipping process. Many shippers fail at this step because weight limits are not explicitly stated in purchase orders or packing instructions.

Implementation steps:

Calculate maximum cargo weight: Subtract 2.5 tons from the 24-ton limit for container tare weight and buffer, giving you 21.5 tons maximum.

Instruct suppliers: Include explicit weight limits in purchase orders and packing instructions as hard limits.

Request VGM verification: Obtain verified gross mass documentation before the container leaves the supplier's facility.

Adjust packing: If approaching weight limits, split shipments across two containers rather than maximizing one box.

This strategy works best for cargo with predictable weight characteristics. It becomes less practical for consolidated shipments from multiple factories or cargo with variable moisture content.

Strategy 2: Clear Customs at Dammam Port and Ship by Truck

When cargo weight cannot be reduced below 24 tons, routing around the railway entirely becomes the most reliable solution. This requires changing your booking destination and customs clearance location.

Instead of booking cargo to "Riyadh Dry Port," specify "Dammam Port" as the final destination on your bill of lading. This instructs the shipping line to treat Dammam as the end point of ocean carriage rather than an intermediate transfer point.

Once the container is discharged at Dammam, you arrange customs clearance directly at the port using a local customs broker. After clearance is completed, the cargo is loaded onto heavy-duty road transport for delivery to Riyadh.

Implementation steps:

Book to "Dammam Port": Specify Dammam as place of delivery on the bill of lading, not Riyadh.

Clear customs at Dammam: Engage a local customs broker to complete import documentation and duty payments at the coastal location.

Arrange specialized transport: Heavy cargo requires 3-axle trailer equipment compliant with Saudi highway regulations.

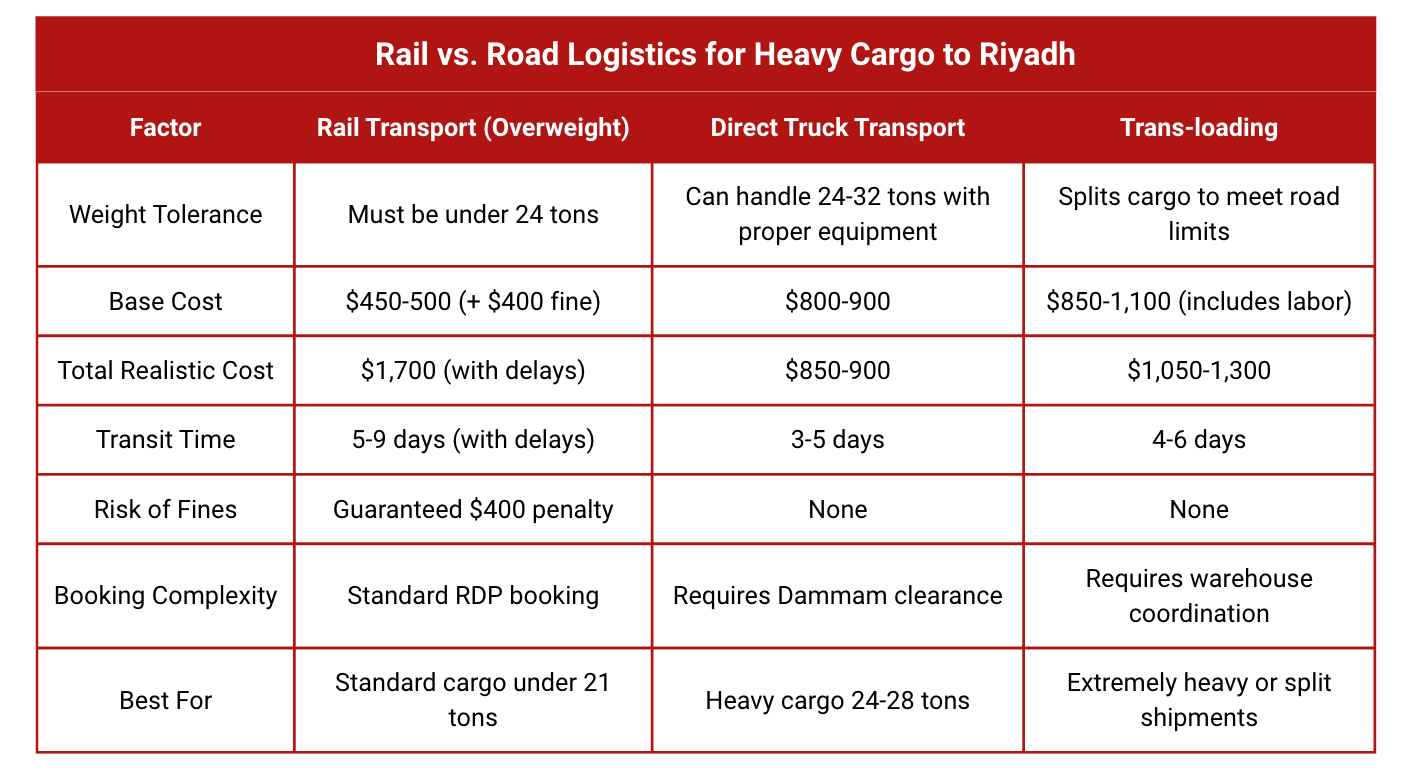

Compare costs: Truck transport costs $800-900 versus rail's $1,700 total (with $400 penalty + delays), delivering in 3-5 days with no penalty risk.

Strategy 3: Trans-load Heavy Cargo at Dammam

For extremely heavy cargo that exceeds both rail limits and standard truck capacity, or for consolidated shipments that can be efficiently split, trans-loading offers a solution.

Trans-loading involves stripping the container at Dammam port or a nearby warehouse facility. The cargo is then reloaded onto multiple trucks for separate deliveries. This approach is most common for machinery, bulk raw materials, or consolidated shipments from multiple suppliers that are being distributed to different Riyadh locations anyway.

When to consider this strategy:

Single items (machinery, industrial equipment) that cannot be split but exceed 24 tons

Consolidated containers with cargo destined for multiple Riyadh consignees

Situations where the cost of trans-loading labor is offset by avoiding specialized heavy transport or extended delays

Cost considerations:

Trans-loading adds labor costs ($200 to $400 depending on cargo complexity), potential repackaging expenses, and coordination overhead. However, for certain cargo types, it remains the only viable option when weight cannot be reduced and dimensions prevent air freight alternatives.

This strategy requires advance planning and coordination with a logistics provider who operates warehousing facilities near Dammam Port. It is not suitable for last-minute solutions or urgent deliveries.

Comparison: Rail vs Truck vs Trans-loading for Riyadh Shipments

Why Choose Gerudo Logistics for Saudi Arabia Shipping

At Gerudo Logistics, we specialize in navigating the technical complexities of Saudi logistics, including SAR railway restrictions, so you can focus on your business.

Pre-shipment Analysis - We calculate gross weight and flag potential rail violations at the quotation stage, presenting routing alternatives before you commit to booking.

Cost Transparency - Receive accurate total landed cost comparisons across rail, truck, and trans-loading options, not just the cheapest freight quote hiding penalty risks.

Local Coordination - Our local team works directly with port terminals, railway operators, and customs authorities, monitoring discharge, weight verification, and transfers in real-time.

Proactive Communication - Get immediate notification of weight issues or delays with revised timelines and cost impacts, eliminating surprise charges.

Contact us today for a complimentary weight audit and routing strategy for your Riyadh shipments.

Frequently Asked Questions

1. What is the exact weight limit for a 20ft container on the SAR rail?

The gross weight limit is 24 metric tons (cargo plus container tare weight). Keep cargo weight under 21 tons to stay within the limit after adding the 2.2-2.3 ton container weight.

2. Does the $400 fine apply to 40ft containers?

The $400 penalty is specific to 20-foot containers. Forty-foot containers have different thresholds based on axle configuration, but the same overweight principle applies.

3. Can I negotiate the overweight penalty with SGP?

No. The $400 charge is a standard published tariff, not negotiable. Your options are to pay the fee and wait for specialized equipment, or divert cargo to truck transport.

4. What is "Riyadh Dry Port" (RDP)?

Riyadh Dry Port is an inland customs clearance facility where containers arriving by rail from Dammam Port undergo inspection and documentation processing.

5. How long are the delays if a container is flagged?

Typical delays range from 3 to 5 days for specialized rail wagons. During peak seasons (September to November), delays can extend to 7 days or longer.

6. Does the limit change seasonally?

The 24-ton structural limit does not change. However, during peak periods, competition for specialized equipment increases, extending processing time.

7. What documentation do I need for Dammam-Riyadh shipments?

Standard requirements include commercial invoice, packing list with weights, certificate of origin, and verified gross mass (VGM) declaration. VGM accuracy is critical for rail eligibility.

Conclusion

The 24-ton SAR railway weight limit creates a $400 penalty trap that escalates into $1,250+ total costs when delays trigger demurrage, storage, and handling charges. For manufacturers operating just-in-time supply chains, these disruptions damage customer relationships beyond any financial penalty.

Success requires enforcing 21-ton cargo limits in packing instructions, verifying gross weight before vessels depart China, and making informed routing decisions at the booking stage.

When heavy cargo cannot be avoided, direct truck transport or trans-loading operations eliminate penalty risks while maintaining delivery schedules. Weight management is a strategic decision, not an operational detail, that determines whether your Saudi Arabia supply chain operates profitably or accumulates unexpected costs with every shipment.