Frozen Food Shipping from China to the Middle East: 2026 Cold Chain Guide

The frozen food trade lane between China and the Middle East has grown substantially over the past five years. Several factors drive this trend.

First, China's frozen food processing industry has matured significantly, with modern IQF (Individually Quick Frozen) facilities and strict quality control systems that meet international standards.

Second, the cost advantage remains compelling for B2B buyers. When you compare unit economics, Chinese suppliers often deliver 15-25% better pricing than alternative origins for comparable quality grades.

Third, the Middle Eastern market has seen strong demand growth across both retail and HORECA (hotel, restaurant, catering) channels. Population growth in the GCC, combined with rising consumer preference for convenient meal solutions, has created consistent year-round demand for frozen vegetables, seafood, prepared foods, and fried snacks.

However, shipping frozen food from China to the Middle East presents distinct challenges. Temperature integrity must be maintained across a supply chain that typically spans 18-28 days for ocean freight. Documentation requirements are strict, particularly around Halal certification and Arabic labelling compliance. Port congestion, inspection holds, and last-mile cold storage coordination can all introduce risk. Understanding both the logistics mechanics and the regulatory landscape is essential for success in this trade.

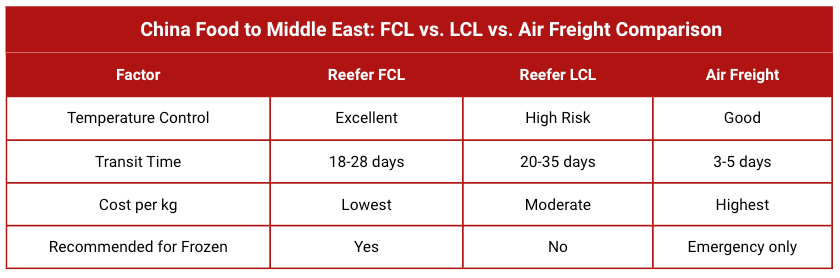

Understanding Reefer Container Shipping: FCL vs. LCL Options

Full Container Load (FCL) Reefer Shipping

For most frozen food shipments from China to the Middle East, a 40-foot high-cube reefer container operating at -18°C or colder is the standard choice. This method provides maximum control over temperature, loading practices, and cargo security throughout the journey.

Typical Transit Times (Port to Port):

Shanghai/Ningbo to Jebel Ali: 18-22 days

Qingdao to Jebel Ali: 20-24 days

Shanghai to Jeddah: 22-26 days

Dalian to Dammam: 24-28 days

These estimates assume direct sailings. Transshipment routing can add 5-10 days but may offer cost savings for smaller buyers willing to accept longer transit.

Reefer FCL Advantages:

Complete control over temperature set point and continuous monitoring

No cross-dock exposure or mixed-cargo contamination risk

Simplified responsibility chain for temperature claims and quality disputes

Easier customs clearance process with single shipper documentation

Better protection for high-value or sensitive products

Why LCL Is Not Recommended for Frozen Food

While reefer LCL consolidation services exist in certain corridors, we strongly advise against this option for frozen food shipments.

LCL requires multiple handling touchpoints at consolidation warehouses, exposing your cargo to temperature fluctuations during the 2-5 day consolidation process. Liability becomes unclear when temperature deviation occurs across multiple parties.

Additionally, genuine reefer LCL services are limited on China to Middle East lanes, and the true cost often approaches FCL rates when you factor in higher insurance premiums and potential quality claims. If your volume is insufficient for FCL, consider coordinating with other buyers to share a container or waiting until you accumulate enough volume.

Air Freight for Frozen Food: When Does It Make Sense?

Air freight for frozen products is typically 8-12 times more expensive than ocean reefer on a per-kilogram basis. However, specific scenarios justify the premium cost.

These include urgent replenishment when stock outages threaten customer commitments, high-value premium SKUs where margin supports elevated logistics cost, short remaining shelf-life situations where ocean transit would compromise product quality, or market-testing small quantities before committing to FCL volumes.

When using air freight, work with forwarders experienced in temperature-controlled air cargo. Dry ice supplementation and insulated packaging are common requirements. Ground handling at both origin and destination airports must include cold storage facilities to maintain temperature integrity during the transfer process.

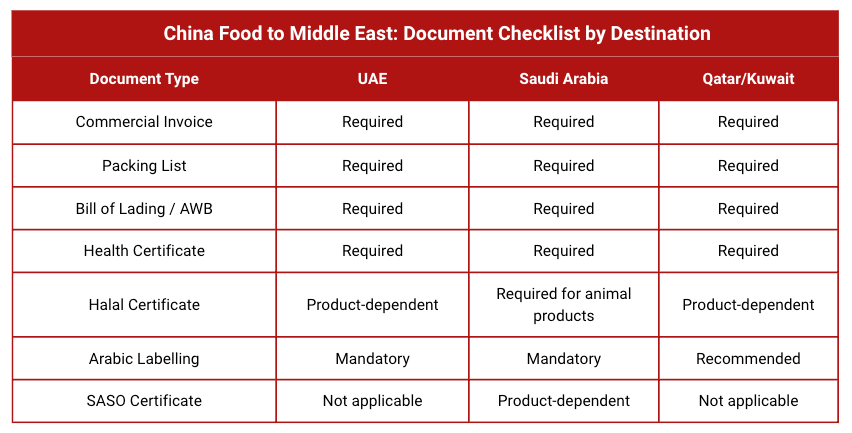

Essential Documentation and Certification Requirements

Core Shipping Documents From China to Middle East

Every frozen food shipment from China to Middle East destinations requires baseline documentation.

The commercial invoice must accurately describe product, HS code, quantity, unit value, and total value. Undervaluation creates customs issues and potential penalties.

The packing list should detail carton count, net weight, gross weight, and pallet configuration. This document supports physical inspection and duty calculation.

For ocean freight, the bill of lading serves as the transport contract and title document.

For reefer containers, ensure it specifies the agreed temperature set point. For air freight, the air waybill serves the equivalent function and should note any special handling requirements for temperature-controlled cargo.

Product-Specific Certificates for Food Shipping to Middle East

Health and Sanitary Certificates

Most Middle Eastern countries require official health certificates for imported frozen food. These certificates are typically issued by Chinese quarantine authorities (GACC - General Administration of Customs China) or provincial CIQ (China Inspection and Quarantine) offices.

The certificate confirms that the product was processed under hygienic conditions, underwent inspection, and is fit for human consumption. Requirements vary by product category. Frozen seafood typically requires more detailed certification than frozen vegetables. Work with your supplier to ensure certificates are applied for early in the production process, as issuance can take 3-7 business days.

Halal Certification: When Is It Required?

This is one of the most frequent questions we receive from new importers. The answer depends on your destination country and product type.

Saudi Arabia Halal Requirements (SFDA Guidance):

According to Saudi Food and Drug Authority regulations, Halal certificates are mandatory for food products containing animal-origin components. This includes meat, poultry, gelatin, certain emulsifiers, and dairy from specific sources. Halal certificates are also required for products that display the term "Halal" on packaging or marketing materials.

Products that are entirely plant-based, such as frozen vegetables, fruits, and fries made with vegetable oil, typically do not require Halal certification. However, if processing equipment is shared with non-Halal products, some buyers request certification as a precaution.

UAE Halal Requirements:

UAE does not mandate Halal certification for all food imports. However, products containing meat or animal derivatives should carry certification from recognized Islamic authorities. Many UAE importers request Halal certificates even for borderline categories to ensure smooth retail distribution and consumer acceptance.

Obtaining Recognized Halal Certification:

Work with Chinese suppliers who maintain relationships with accredited Halal certification bodies. Recognized certifying organizations include China Islamic Association, Ningxia Halal Certification Center, and regional Islamic associations in provinces with significant Muslim populations. Verify that your buyer or destination country authority accepts the specific certification body before shipping. Some Middle Eastern countries maintain approved lists of foreign Halal certifiers.

SASO Certification and SFDA Registration

SASO Certification:

SASO (Saudi Standards, Metrology and Quality Organization) certification applies to specific regulated product categories. Not all frozen food requires SASO certification. The requirement depends on whether your product falls under mandatory conformity assessment programs.

Generally, frozen food products that comply with relevant Gulf standards (GSO standards) and have appropriate health certificates can clear Saudi customs without separate SASO certification. However, certain processed foods or products with specific additives may require SASO conformity certificates.

Before your first shipment, consult with your customs broker in Saudi Arabia to verify current SASO requirements for your specific HS code and product description.

SFDA Registration:

Food products entering Saudi Arabia must comply with SFDA requirements. For many frozen food categories, this involves registration of the manufacturing facility with SFDA and compliance with GSO labelling standards. Your supplier or their export agent should be able to provide documentation showing facility registration status.

Arabic Labelling Requirements for Food Import

UAE and Saudi Arabia Labelling Rules:

Both countries generally require Arabic labelling or bilingual (Arabic/English) labels on retail food packages. UAE labelling standards require product name, ingredients list, net weight, production and expiry dates, country of origin, importer name and address, and storage instructions to be displayed in Arabic.

Saudi Arabia similarly requires Arabic labelling aligned with SFDA and GSO standards, covering product identity, full ingredient declaration, allergen information, date marking, storage and handling instructions, and nutritional information for products above certain volume thresholds.

Practical Labelling Strategy:

If you are sourcing private-label frozen products, coordinate Arabic-compliant artwork with your Chinese supplier before production begins. Most experienced exporters can print bilingual labels or Arabic labels directly at the factory. This eliminates costly relabelling operations at destination.

For branded products where label changes are not feasible, you may need to apply compliant stickers at a warehouse in the destination country before distribution. This adds cost and handling time but is sometimes the only option for established brand packaging.

Most Popular Frozen Food Categories Shipped from China to the Middle East

Understanding which products dominate this trade lane helps you benchmark your own sourcing decisions. The following categories consistently show high volume and strong market acceptance across GCC markets.

Frozen Seafood from China's Coastal Regions

Fujian Abalone (Frozen Whole and Processed)

Fujian province is recognized globally for its abalone aquaculture. Frozen abalone from Fujian suppliers is exported in multiple formats: whole cleaned, sliced, and ready-to-cook preparations. Middle Eastern importers prize this product for high-end restaurant menus and premium retail. Quality depends on rapid freezing immediately after harvest and maintaining strict temperature during the entire journey.

When sourcing Fujian abalone, verify that your supplier uses blast freezing or IQF methods to preserve texture. Request temperature records from production through container stuffing. The product should be packed in moisture-barrier materials to prevent freezer burn during the 20-25 day ocean transit to Jebel Ali or Jeddah.

Check our Seafood refeer container shipping guide for more logistics advice.

Frozen Shrimp and Mixed Seafood

China supplies significant volumes of vannamei shrimp, black tiger shrimp, squid, calamari rings, and mixed seafood assortments to GCC markets. Sizing accuracy, glazing percentage, and species verification are critical for buyer acceptance. Ensure your supplier provides transparent net weight declarations and can support third-party inspection if required by your buyer.

Ningxia Lamb and Halal Meat Products

Ningxia Hui Autonomous Region has become a major hub for Halal-certified frozen lamb production. The region's Muslim population and established slaughter processes aligned with Islamic requirements make it a natural sourcing point for Middle Eastern importers.

When sourcing frozen lamb from Ningxia, confirm that the slaughterhouse holds valid Halal certification recognized by your destination country. For Saudi Arabia imports, SFDA (Saudi Food and Drug Authority) maintains specific lists of approved foreign establishments. For UAE, certification from recognized bodies such as EIAC (Emirates International Accreditation Centre) is typically required.

Frozen lamb is typically shipped in carton packs of 10-25kg, arranged on pallets inside a 40-foot high-cube reefer container. Proper airflow around cartons is essential. Poor stacking can create warm pockets and compromise product integrity.

Read and learn more our Meat refeer container shipping guide.

Dalian Cherries and Premium Frozen Fruit

Dalian in Liaoning province is famous for cherry production. While fresh cherry export windows are limited to a few weeks annually, frozen IQF cherries extend availability throughout the year. Middle Eastern buyers use frozen Dalian cherries for dessert manufacturing, smoothie supply, and high-end hotel pastry operations.

Frozen fruit requires careful attention to moisture control and packaging. Clumping indicates temperature fluctuation during storage or transport. When you inspect product at destination, individual pieces should separate easily. This is a reliable quality indicator that the cold chain remained stable throughout transit.

Other High-Demand Frozen Products

The following categories also show consistent demand in Middle Eastern markets:

Frozen French Fries and Fried Snacks: Bulk foodservice staple with high rotation in UAE, Saudi Arabia, Qatar, and Kuwait markets

Frozen Dumplings and Spring Rolls: Strong performance in Asian cuisine channels and diversified restaurant concepts

Frozen Mixed Vegetables: IQF blends for HORECA kitchens and retail distribution

Frozen Prepared Foods: Ready meals and dim sum assortments require higher documentation scrutiny but offer good margins

How Gerudo Logistics Ensures Successful Frozen Food Delivery

At Gerudo Logistics, we specialize in temperature-controlled shipping from China to Middle East destinations. Our experience handling frozen food imports gives you confidence that your cargo will arrive in optimal condition and clear customs efficiently.

Pre-Shipment Temperature Verification: We coordinate Pre-Trip Inspection (PTI) for reefer units before loading, confirming refrigeration machinery operates correctly and can maintain your required set point throughout the journey. We document PTI results and share reports with you for quality assurance records.

Container Loading Supervision: Our team ensures proper cargo arrangement for optimal air circulation, correct positioning of temperature data loggers, and secure load configuration to prevent shifting during transit. Poor loading is one of the most common causes of temperature excursions.

Continuous Temperature Monitoring: Modern reefer containers include integrated monitoring systems that record temperature every hour. We provide access to these temperature logs so you can verify cold chain integrity throughout transit. If any deviation occurs, we receive immediate alerts and can coordinate intervention with the carrier.

Documentation Compliance Support: We work with you to ensure all required certificates and documents are prepared correctly before departure. Our established relationships with Chinese health certificate issuers, Halal certification bodies, and customs authorities in major Middle Eastern ports streamline this process. We review your documentation package before shipment and flag any issues early.

Customs Clearance Coordination: When your container arrives at Jebel Ali, Jeddah, Dammam, or other GCC ports, we coordinate with licensed customs brokers who understand frozen food import procedures. This includes pre-clearance document submission where permitted, coordination of required inspections, and arrangement of cold storage if clearance extends beyond standard timelines.

Cold Chain Last Mile: We arrange refrigerated trucking with GPS monitoring and temperature logging, working only with carriers who maintain dedicated reefer fleets and proper maintenance programs. This eliminates the risk of using converted trucks or poorly maintained equipment.

Case Study: Frozen Seafood Import Success from Fujian to Dubai

Client Background: A Dubai-based foodservice distributor specializing in premium seafood for five-star hotels and high-end restaurants.

Challenge: The client wanted to source frozen abalone and mixed seafood assortments from Fujian province. Previous shipments with another forwarder had experienced temperature fluctuations and one instance where incorrect documentation caused a five-day customs hold.

Our Solution: We selected direct service from Xiamen to Jebel Ali with 19-day transit, avoiding transshipment and coordinated with the client's UAE customs broker to submit health certificates and commercial documents before vessel arrival. We also arranged standby cold storage space at Jebel Ali in case inspection held the container beyond free time.

Results: The container arrived with perfect temperature records showing consistent -20°C throughout the journey. Customs clearance was completed within 36 hours of discharge. Product quality inspection by the client showed zero defects. The client has since shipped 12 additional containers through our service with zero incidents.

Complete Frozen Food Shipping Process to Middle East: Step-by-Step Timeline

Understanding the full timeline helps you plan inventory, coordinate with buyers, and manage cash flow effectively.

Weeks 1-2: Pre-Production and Preparation

Product ordering and production scheduling with your Chinese supplier. Container booking and sailing schedule confirmation with Gerudo Logistics. Health certificates and Halal certificates (if required) are issued by authorized Chinese agencies. Container stuffing occurs under supervision with temperature data loggers activated. Container is sealed and transported to the departure port.

Week 3: Port Operations and Departure

Container arrives at Chinese port (Shanghai, Ningbo, Qingdao, Xiamen, or other departure points). Container is connected to reefer monitoring system and placed in loading queue. Container is loaded onto vessel and final documentation package is completed. Vessel departs and you receive container tracking information with expected arrival date.

Weeks 4-6: Ocean Transit

Container maintains -18°C to -20°C during the 18-28 day journey across the Indian Ocean, depending on your specific routing. Modern reefer containers provide excellent temperature stability during this phase. Remote temperature monitoring confirms cold chain integrity throughout transit.

Week 7: Arrival, Clearance, and Delivery

Container discharges at destination port and is placed in port reefer yard with power connection. Destination customs broker submits clearance documents and port health authority conducts inspection if selected. Customs clearance completes and applicable duties and fees are paid. Refrigerated truck picks up container and delivers to your warehouse or customer facility under temperature-controlled conditions.

Total Timeline: Approximately 7 weeks from production start to final delivery for ocean freight. Air freight can reduce this to 2-3 weeks but at significantly higher cost.

Frequently Asked Questions to Ship Frozen Food from China to the Middle East

Q: What shipping method is best for frozen food from China to the Middle East?

A: Reefer ocean freight using FCL is the default choice for stable, high-volume products due to better unit economics. Air freight is reserved for urgent replenishment or premium products. Ocean reefer costs approximately 8-12 times less per kilogram than air freight.

Q: What temperature should frozen food be kept at during transport?

A: The industry baseline is -18°C or colder with continuous monitoring and documented temperature records. We recommend setting reefer containers to -20°C to provide a safety margin against minor fluctuations.

Q: Can I ship frozen food as LCL instead of FCL?

A: We do not recommend LCL for frozen food due to high temperature control risks from multiple handling touchpoints, extended dwell time at consolidation facilities, and unclear responsibility boundaries if temperature issues occur. FCL provides the necessary control and protection for frozen products.

Q: What are the most common reasons for delays in the Middle East?

A: Typical causes include documentation gaps (missing certificates, label non-compliance), inspection holds by health authorities, port congestion or appointment delays, and insufficient cold storage arrangements after cargo discharge. Proper documentation preparation and pre-clearance coordination significantly reduce these risks.

Q: Do I need Arabic labelling for imports to UAE and Saudi Arabia?

A: Yes, both countries require Arabic labelling or bilingual (Arabic/English) labels on retail food packages. Requirements include product name, ingredients, net weight, production and expiry dates, country of origin, and importer details in Arabic. For bulk foodservice packs that will be repackaged, requirements may differ.

Q: When is a Halal certificate required for Saudi imports?

A: According to SFDA guidance, Halal certificates are required for products containing animal-origin components (meat, poultry, gelatin, certain emulsifiers) and products displaying "Halal" on labels. Plant-based frozen products like vegetables and fruits typically do not require Halal certification unless processed on shared equipment.

Q: How do I prevent temperature excursions and quality claims?

A: Confirm reefer container condition through Pre-Trip Inspection (PTI), set correct temperature with safety margin (-20°C recommended), follow proper loading practices that ensure good airflow around cargo, implement continuous monitoring with data loggers, and establish clear chain of custody for temperature responsibility between carrier, forwarder, trucker, and warehouse.

Conclusion: Partnering for Cold Chain Success

Frozen food shipping from China to the Middle East requires specialized knowledge, careful planning, and experienced logistics partners. Temperature integrity, regulatory compliance, and timing precision are fundamental requirements for success in this market. The products you import represent significant investment and customer commitments that demand professional cold chain management.

At Gerudo Logistics, we bring comprehensive expertise to every shipment. Our team has successfully delivered hundreds of reefer containers from Chinese suppliers to Middle Eastern importers, managing the technical and regulatory details that determine success.

Ready to start your next frozen food import from China? Contact us to discuss your specific requirements. Our cold chain specialists will provide detailed routing options, transparent pricing, and timeline projections customized to your products and destinations.