Guangdong Sourcing 2026: A Strategic Roadmap to Five Hubs and Freight Execution

Guangdong remains the most concentrated manufacturing and trading region in China. For most B2B importers, it is still the logical starting point for sourcing. The Greater Bay Area (GBA) accounts for roughly 25% of China's total exports, and as of 2026, that output has shifted in composition: high-value electronics, smart home products, and engineered materials now sit alongside the textiles and furniture categories that built the region's reputation.

This guide covers the five primary sourcing clusters in Guangdong, with practical freight and compliance notes at each stop. If you are planning a sourcing trip or placing purchase orders this year, the information below will help you match your product category to the right location and understand the logistics considerations before your cargo leaves China.

Why Guangdong Remains China's Top Sourcing Region in 2026

The GBA's advantage is not just manufacturing scale. It is the density of supporting industries packed into a compact geography. A product assembled in Dongguan might use components from Shenzhen, packaging from Guangzhou, and raw materials shipped through Nansha Port. That proximity reduces lead times and simplifies coordination.

Three factors keep Guangdong ahead of competing manufacturing regions:

Port infrastructure: Shenzhen Yantian, Shekou, and Guangzhou Nansha rank among the world's highest-capacity container ports, with extensive weekly sailings to the Middle East, Europe, Africa, and the Americas.

Supplier maturity: Factories here have been exporting for 30-plus years. Most understand third-party inspections, export documentation, and international certification requirements.

Freight forwarding ecosystem: Guangzhou and Shenzhen host thousands of licensed freight forwarders with experience in complex cargo including dangerous goods and temperature-controlled shipments.

For importers evaluating Vietnam or India, those are valid options for specific product lines. Vietnam in particular has gained ground in garments and furniture manufacturing. But for buyers who need to source across multiple categories in a single trip, Guangdong's combination of product variety, supplier experience, and port access still has no direct equivalent in Asia.

5 Key Sourcing Hubs in Guangdong: Products, Markets, and Freight Notes

1. Shenzhen: Electronics, Hardware, and AI Components

Shenzhen is the right destination for consumer electronics, PCBs, drones, smart devices, and precision components. For a detailed breakdown of Shenzhen's electronics markets, visit our Shenzhen Electronics Market Sourcing Guide.

Huaqiangbei remains the practical center for electronics procurement:

Seg Plaza: Electronic components, integrated circuits, passive components

Huaqiang Electronics World: Consumer electronics, accessories, finished products

Seg Communications Market: Mobile phone components, repair parts, accessories

Beyond Huaqiangbei, Bao'an District is the primary cluster for drone manufacturing, smart wearable devices, and AI hardware peripherals. The area hosts OEM manufacturers with varying levels of export experience, ranging from established exporters with full certification documentation to smaller factories better suited for buyers willing to handle compliance themselves.

Freight note: Lithium batteries, whether standalone or installed in devices, require UN38.3 test reports, an MSDS, and an official Cargo Transport Appraisal Report under IATA DGR. Airlines and ocean carriers typically require all three documents before confirming a DG booking. Non-compliant cargo is routinely rejected at Shenzhen Bao'an Airport. Confirm your supplier's documentation package, not just the UN38.3 report, before booking air shipments.

2. Guangzhou: Apparel, Beauty Products, and Leather Goods

Guangzhou's wholesale markets are organized by product category, making structured buying trips efficient.

Apparel:

Baima and Huimei: Mid-to-high range fashion, suitable for boutique retail and online categories

Shisanghang: High-volume fast fashion, best for buyers prioritizing speed and margin

Beauty and Cosmetics:

Xingfa and Yifa Plaza: One of Asia's largest cosmetics wholesale concentrations, covering skincare, color cosmetics, fragrances, and personal care. OEM and branded products are both available.

Leather Goods:

Ziyuangang: Mid-market bags, luggage, belts

Guihuagang: Entry-level leather accessories

Freight note: Cosmetics with aerosol formulations or alcohol content above 24% by volume are classified as dangerous goods under IMDG and IATA DGR. Verify the hazard classification of each SKU with your freight forwarder before booking. Guangzhou Baiyun Airport is one of China's busiest air cargo hubs, making it well-suited for fast-fashion replenishment on 2-to-5 day delivery windows.

3. Foshan: Furniture, Ceramics, and Building Materials

Foshan is the primary sourcing destination for large-format home goods and construction materials.

Key districts:

Lecong Furniture Zone: A permanent wholesale city for furniture spanning multiple exhibition halls. Product range covers Italian-style upholstery, solid wood Chinese furniture, and flat-pack office systems. The market has dedicated export coordination services for international buyers.

Shiwan and Nanzhuang: Ceramic tiles, bathroom fixtures, sanitary ware, and decorative stone. Suitable for both finished product buyers and project developers importing for hospitality or residential construction.

Freight note: Furniture and ceramics are heavy and fragile. Sea freight is standard. LCL consolidation works well for sample orders or mixed-product sourcing trips. For Foshan cargo, both Guangzhou Nansha and Shenzhen Shekou are practical gateways via Pearl River barge. Shekou carries higher international sailing frequency, particularly to Europe and North America, making it the stronger option when transit time to those markets matters.

For solid wood furniture, fumigation treatment and a phytosanitary certificate are mandatory for most destination markets. Confirm this requirement in your purchase order terms.

4. Zhongshan and Guzhen: Lighting and LED Products

Guzhen Town in Zhongshan is where the majority of China's decorative and architectural lighting is designed, manufactured, and exported.

Key markets:

Starlight Alliance: High-end decorative lighting, crystal chandeliers, designer fixtures

Times Plaza: Commercial and export-oriented LED strips, functional fixtures for hospitality and retail

Guzhen runs trade shows multiple times per year, with the largest events attracting international buyers in spring and autumn. Timing a sourcing visit to coincide with these events gives buyers access to a wider product range and the opportunity to meet factory representatives directly rather than going through trading companies.

Freight note: Glass and crystal fixtures require reinforced packaging, typically custom foam inserts and double-wall cartons. Breakage rates on under-packed lighting shipments are high. For high-value decorative items, cargo insurance is worth including in your landed cost calculation.

5. Dongguan: Precision Manufacturing and Industrial Components

Dongguan is primarily a manufacturing city rather than a trading hub. Buyers deal directly with factories rather than wholesale markets.

Manufacturing strengths:

Precision plastics and injection molds: High concentration of mold makers; suited for OEM buyers needing custom components

Footwear and accessories: Major production center for mid-range international brands

Electronic sub-assemblies: PCB assembly, cable harnesses, industrial electronics

Freight note: Dongguan cargo typically exits through Shenzhen Yantian or Shekou. Dongguan's Bonded Logistics Center (B type) at Shijie offers cross-border e-commerce and transit cargo services. For buyers importing components that will be re-exported after processing, this facility can reduce duty exposure.

Guangdong Port Strategy: Choosing the Right Gateway for Your Cargo

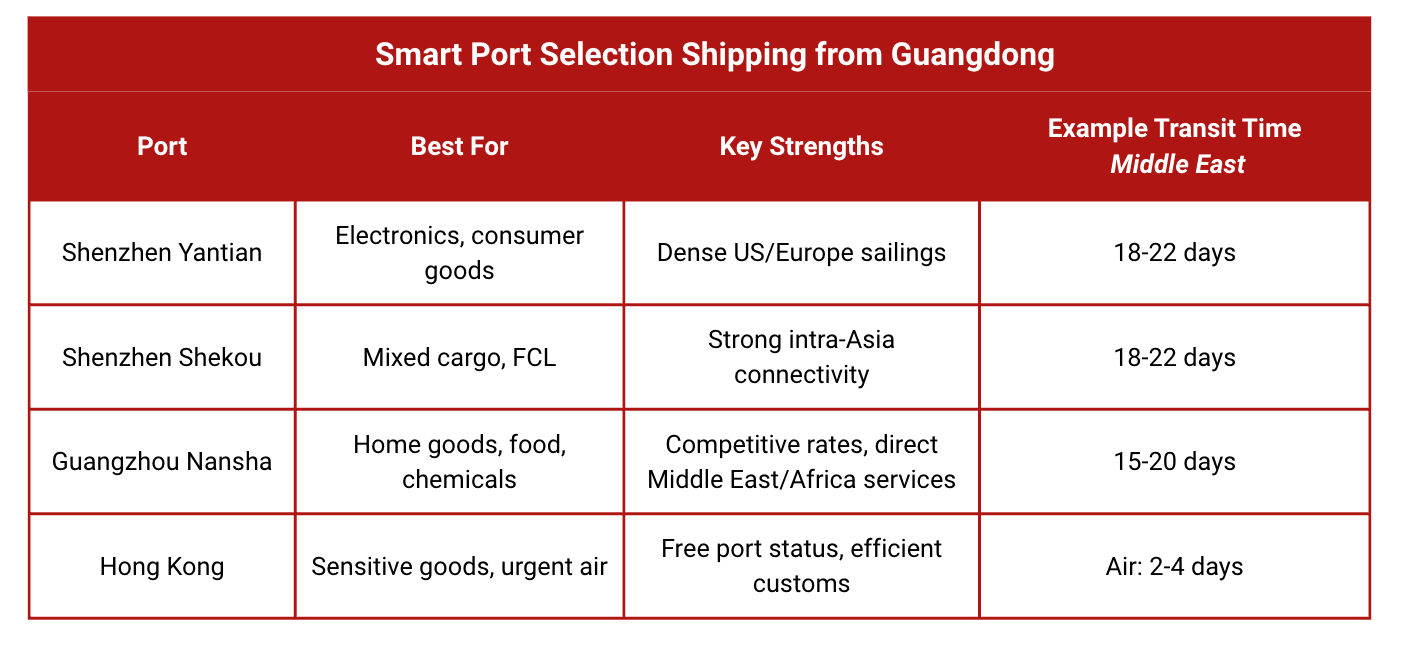

Most importers default to whichever port their supplier suggests, which is almost always Shenzhen Yantian. That works for US and European cargo, but it is not necessarily the best choice for buyers shipping to the Middle East, Africa, or Southeast Asia.

Guangzhou Nansha is the most underutilized port among international buyers. It has expanded direct services to the Middle East, Africa, and Southeast Asia, with rates on these lanes frequently more competitive than Shenzhen equivalents.

A buyer shipping ceramic tiles from Foshan to Jebel Ali, for example, can save on both inland trucking and ocean freight by routing through Nansha rather than driving cargo to Yantian. Buyers shipping home goods, ceramics, or food products to GCC or East African markets should specifically ask their freight forwarder to quote Nansha alongside Shenzhen before confirming the booking.

Hong Kong remains relevant for cargo with regulatory complexity that benefits from free port status, and for urgent air freight where Chek Lap Kok's international connectivity outperforms Guangzhou Baiyun on certain routes, particularly for time-sensitive shipments to Europe and North America.

The Pearl River Barge Advantage

For suppliers in Foshan, Zhongshan, or inland Dongguan, road trucking to Shenzhen is the default inland option. For heavy cargo like furniture or ceramics, it is not the cheapest one.

Pearl River barge service connects inland river ports directly to main ocean terminals:

Loading points include Foshan Beijiao, Zhongshan Xiaolan, and Jiangmen

Barge schedules feed into both Guangzhou Nansha and Shenzhen Shekou

Rates for heavy cargo typically run 30-50% below equivalent road freight

Transit adds roughly 12-24 hours, acceptable for sea freight shipments

Most suppliers will not suggest this unprompted. If your cargo originates in the Pearl River Delta interior, ask your freight forwarder to run a barge comparison before confirming inland transport.

China Freight Guide: Consolidation, DG Handling, and Mode Selection

Multi-Supplier Consolidation from Guangdong

Most Guangdong sourcing trips span multiple cities. Shipping each supplier's goods separately multiplies freight costs, creates multiple customs entries, and adds documentation complexity.

The consolidation model:

Suppliers deliver to a central freight forwarder warehouse in Guangzhou or Shenzhen

The forwarder receives, inspects, and repacks all goods into a single export container

One set of export documentation covers the entire shipment

Customs clearance at destination is handled in a single entry

Three things to plan for:

DG cargo requires physical separation. Batteries, aerosols, and flammable liquids cannot be consolidated with non-DG cargo without specific carrier approval. Declare regulated products to your freight forwarder before consolidation planning begins.

Set a unified delivery deadline. One late supplier holds the entire shipment. Build 3-5 days of buffer into supplier delivery instructions.

Collect documentation in parallel. Missing invoices or certificates from one supplier delay export declaration for all cargo in the container.

Specialized Handling: Fragile Cargo and Dangerous Goods

Fragile and oversized cargo (furniture, lighting, ceramics):

Solid wood furniture requires export fumigation and a phytosanitary certificate. Suppliers serving domestic buyers may not have this in place.

Crystal and glass fixtures need custom foam inserts and double-wall cartons. Standard supplier packaging frequently fails during sea freight transit.

All-risk marine cargo insurance is recommended for high-value decorative items. Standard carrier liability covers a fraction of actual cargo value.

Dangerous goods (DG) from Guangdong:

Guangdong is a high-volume source of DG-classified products: lithium battery devices from Shenzhen, aerosol and fragrance cosmetics from Guangzhou, adhesives and chemical cleaners from industrial manufacturers across the region. A compliant DG shipment requires:

Classification: Correct UN number, hazard class, and packing group

Packaging: UN-certified packaging matched to the packing group

Documentation: MSDS, DG declaration, and destination-market certificates

Carrier declaration: DG details submitted to ocean carrier or airline before booking confirmation

Buyers sourcing DG products from multiple suppliers should consolidate compliance review with a single freight forwarder. Inconsistent classification across suppliers in one shipment is a common source of delays.

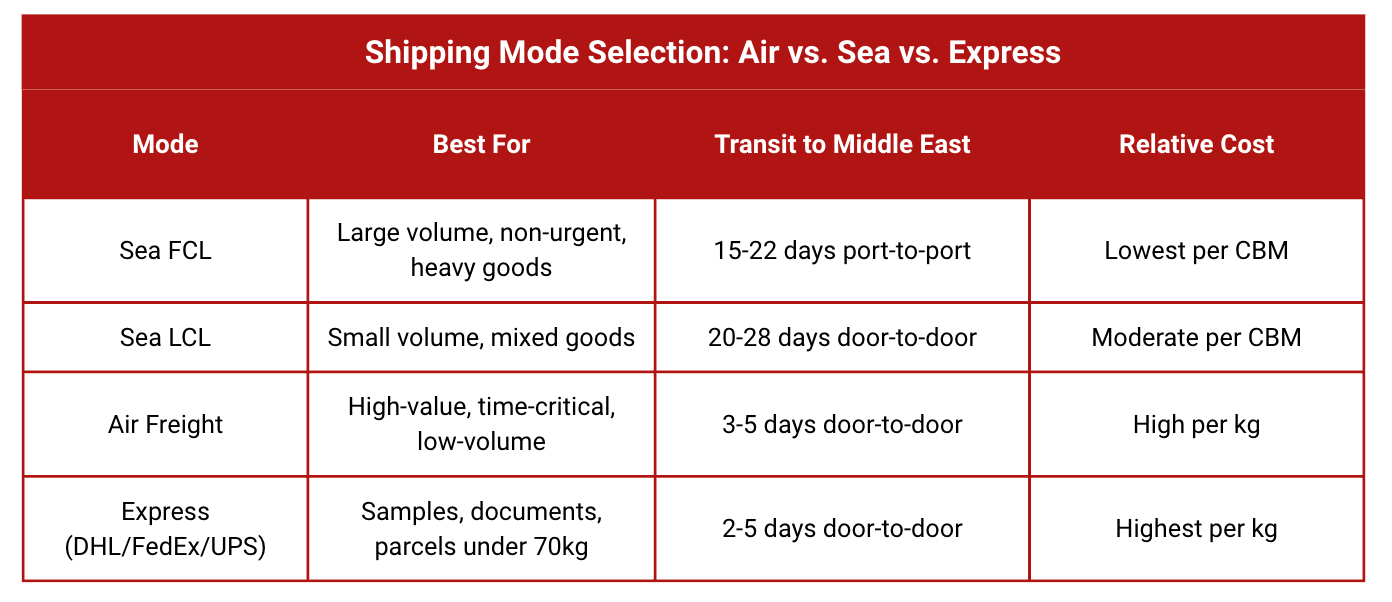

Sea freight is the default for commercial volume. FCL makes sense above approximately 15 CBM. LCL suits smaller orders but carries higher per-unit costs and longer transit due to consolidation handling.

Air freight is justified when delay cost exceeds freight cost. Buyers in fast-moving categories often use air for first shipments or emergency replenishment, then transition to sea once inventory cycles stabilize. A practical way to frame the decision: if your product carries a gross margin above 40% and a weekly sales velocity where a 20-day sea transit creates a stockout, air freight may be the better choice even at 5-6x the per-kg cost. The comparison is not air cost versus sea cost; it is air cost versus the margin lost during the stockout window.

Express courier works for samples, documents, and small parcels under 70kg. For commercial shipments above that threshold, dedicated air cargo through a freight forwarder is almost always more cost-effective than express rates, and provides greater control over documentation and compliance requirements.

Export Compliance for Guangdong Sourcing: Certifications and 1039 Trade

Key Compliance Requirements

Electronics certifications: CE (Europe), FCC (US), and RoHS are standard. Request the actual test report, not just the certificate, and confirm it references your specific model and production batch.

Solid wood fumigation: Mandatory for most destination markets. Confirm fumigation and phytosanitary certificate requirements in your purchase order terms before production begins.

DG classification: Cosmetics with aerosol or flammable formulations, lithium battery devices, and chemical products fall under IMDG or IATA DGR. Missing documentation results in cargo rejection at port or airport. See common mistakes in DG Shipping

The 1039 Market Procurement Trade Category

Wholesale market stall operators often cannot issue standard VAT invoices, which complicates export customs declaration for small buyers.

The 1039 Market Procurement Trade category resolves this. In designated pilot markets in Guangzhou, buyers can export goods without standard VAT invoices. The trade category is declared at the customs level by your freight forwarder, who handles the filing on your behalf. This is particularly useful for buyers purchasing across multiple stalls in a single market trip, where issuing a consolidated invoice would otherwise be impractical.

Two important limitations apply.

First, not all markets qualify: eligibility is determined by official pilot market designation, and the approved list is updated periodically. Confirm that your specific sourcing location is covered before relying on this route.

Second, the 1039 category is capped at USD 150,000 per customs declaration. Buyers placing large-volume orders that exceed this threshold will need to use standard trade documentation for the portion above the cap.

Frequently Asked Questions

Q: What is the best port to ship furniture from Foshan? Guangzhou Nansha, given proximity and direct services to the Middle East, Southeast Asia, and Africa. For Europe and the US, Shenzhen Shekou via barge is also practical.

Q: Do Guangzhou cosmetics suppliers handle DG documentation? Some do, many do not. Verify DG classification and packing with your freight forwarder rather than relying on the supplier for aerosol or alcohol-based products.

Q: How long does shipping from Guangdong to the Middle East take? Sea freight is 15-22 days port-to-port, or 20-28 days door-to-door. Air freight is 3-5 days door-to-door.

Q: Can I visit Guangdong wholesale markets without a trading company? Yes. Most markets are open to direct international buyers. Vendors typically prefer WeChat Pay or Alipay, both linkable to international cards. A local freight forwarder representative can assist with supplier verification and logistics coordination on-site.

Q: What certifications do I need for electronics sourced in Shenzhen? CE and RoHS for Europe; FCC and UN38.3 for the US; SASO for Saudi Arabia; ESMA for the UAE. Confirm destination requirements with your customs broker before ordering.

Q: How does the 1039 Market Procurement Trade category work? It allows buyers in designated wholesale zones to export without standard VAT invoices. Your freight forwarder handles the declaration. Not all markets qualify.

Q: Is air freight viable for Foshan furniture or ceramics? Not for volume orders. Sea freight is the only cost-viable option for commercial quantities of heavy cargo.

Why Your China Import Operations Need Gerudo Logistics

Gerudo Logistics is headquartered in Guangzhou with operations across Shenzhen, Shanghai, Ningbo, Qingdao, and Dalian. We specialize in dangerous goods and reefer (cold chain) shipping from China to global markets, with full-service capability covering standard cargo, consolidation, customs clearance, and DDP delivery.

Three capabilities that matter for Guangdong sourcing clients:

End-to-end execution: From factory pickup across the Pearl River Delta to destination delivery, we manage inland coordination, warehouse consolidation, export documentation, ocean or air booking, and clearance under one point of contact.

DG and cold chain compliance: Classification review, UN-certified packaging oversight, MSDS preparation, and carrier declaration under IATA DGR and IMDG are core services, not add-ons. This directly reduces cargo rejection risk for buyers sourcing regulated product categories from Guangdong.

Transport planning for SME importers: We assess mode selection, routing, and consolidation options against your actual timeline and budget. If LCL saves cost without compromising delivery, we recommend it. If air freight is justified by margin and urgency, we explain it with numbers.

Contact us for a shipping quote, mode recommendation, or pre-shipment DG compliance check.

Conclusion

Guangdong in 2026 is a practical and efficient sourcing base across a wide range of product categories. Shenzhen for electronics, Guangzhou for fashion and cosmetics, Foshan for home goods and building materials, Zhongshan/Guzhen for lighting, and Dongguan for precision manufacturing.

Logistics planning should begin before purchase orders are placed. Port selection, mode choice, DG compliance, and consolidation all affect your final landed cost and delivery timeline. The decisions covered in this guide are the ones experienced importers resolve before placing purchase orders. For buyers approaching Guangdong sourcing for the first time, the same decisions often surface as costly surprises mid-shipment.