Importing Food from China to Indonesia in 2026: Navigating Halal Mandates & BPOM Compliance

Indonesia represents one of China's most dynamic food import markets, with bilateral trade reaching significant volumes annually. The world's largest Muslim-majority country offers substantial opportunities for Chinese food exporters, from frozen dim sum in Jakarta shopping malls to bulk garlic for local food manufacturers.

October 17, 2026 marks a critical regulatory milestone. Indonesia's mandatory Halal certification requirement takes full effect on this date, fundamentally changing food import procedures. Combined with existing BPOM ML registration requirements and Indonesia-specific customs procedures, successful market entry now requires comprehensive planning and strict timeline adherence.

This guide addresses the complete compliance framework for shipping food from China to Indonesia in 2026. You will understand Halal and BPOM registration timelines, Indonesia-specific cold chain logistics requirements, complete documentation checklists, and realistic cost structures. Whether you are updating compliance for existing imports or planning market entry, proper preparation prevents costly delays and cargo rejection.

2026 Regulatory Requirements for Food Imports

Mandatory Halal Certification (October 17, 2026 Enforcement)

Indonesia's BPJPH (Badan Penyelenggara Jaminan Produk Halal) enforces mandatory Halal certification for all packaged food and beverages from October 17, 2026. Products arriving without valid BPJPH certification face immediate rejection. Non-Halal products must carry clear labeling, though market acceptance remains limited.

This deadline is established following the 2024 Indonesian government policy, which granted a two-year extension to the mandatory halal certification grace period for food and beverage products.

Critical Transition Requirement: After October 17, 2026, products must display the Indonesian national Halal logo issued by BPJPH. Chinese domestic Halal certificates (such as those from local Islamic associations) are not accepted unless they have been formally recognized through BPJPH's mutual recognition agreement or converted to BPJPH certification. This is a common misunderstanding among Chinese exporters.

LPPOM-MUI to BPJPH Transition: Previously, LPPOM-MUI (Assessment Institute for Foods, Drugs, and Cosmetics of the Indonesian Council of Ulama) issued Halal certificates. In 2024-2025, BPJPH assumed full authority. Existing LPPOM-MUI certificates issued before the transition remain valid until their expiration date, but all renewals and new applications must go through BPJPH.

The certification process requires 4 to 6 months. Factory audits are mandatory for meat products, dairy, and most processed foods. Chinese manufacturers must demonstrate Halal compliance throughout manufacturing, including cross-contamination prevention and ingredient sourcing verification.

Application Requirements: Complete product formulation disclosure, production facility specifications, supplier declarations, manufacturing flowcharts, and Halal assurance documentation. Certificates remain valid for 4 years.

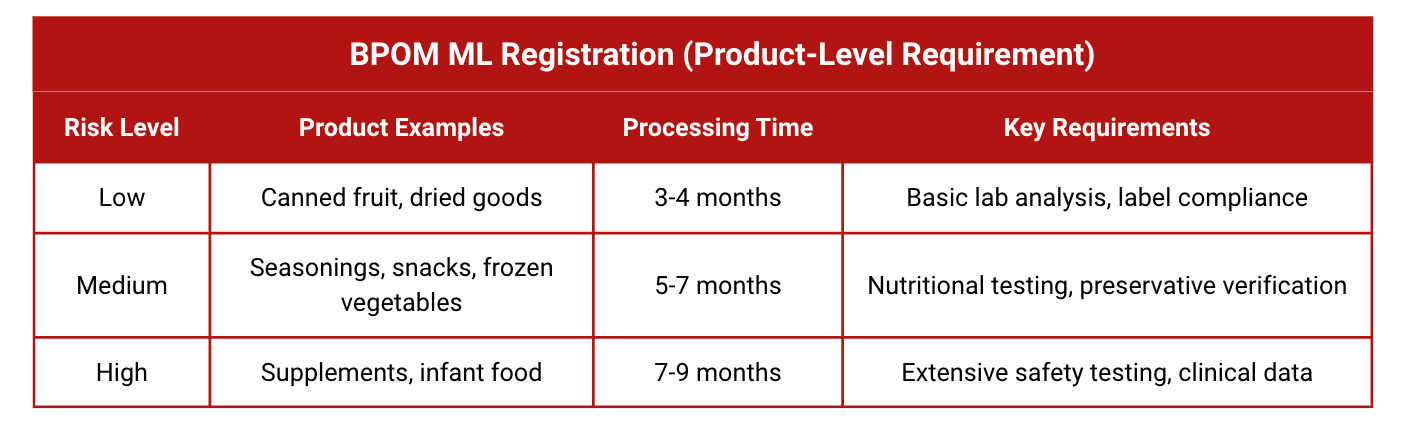

BPOM ML Registration (Product-Level Requirement)

Every food product SKU requires an ML number (Makanan Luar) from BPOM before legal import. Different flavors or package sizes require separate ML numbers.

Critical: Registration must be completed before shipping. Products without valid ML certificates face rejection.

Label Compliance Requirements: BPOM enforces strict formatting standards for product labels. Font size minimums, Halal logo placement, nutritional table proportions, and warning statements (such as alcohol content or pork ingredients) must meet exact specifications. Even minor deviations in layout or logo positioning trigger Red Line rejection.

Recommended Practice: Before committing to mass production packaging, have your Indonesian customs broker or local partner conduct a virtual label review against BPOM guidelines. This prevents costly rejections due to formatting errors that only become apparent during customs inspection.

The registration process involves laboratory testing at BPOM-approved facilities and label compliance review. ML certificates remain valid for 5 years.

Indonesian Import License Requirements

Foreign companies cannot act as Importer of Record. Required: PT or PT PMA registration, NIB (Business Identification Number), and API-U (General Import License).

Option 1 - Register PT PMA: Full control, 6-8 weeks, higher initial investment.

Option 2 - Partner with Licensed Importer: Faster entry (4-6 weeks), lower cost, less control. Works well for market testing.

China-Side GACC Registration

Your Chinese supplier must hold valid GACC registration for food exports. Registration is facility-specific for meat, seafood, and dairy. Verify before purchase order placement.

Common failure: Supplier registered for vegetables but not meat. Shipment clears Chinese customs but Indonesian quarantine rejects entire cargo. Forced return costs $3,000-5,000 plus cargo loss. Request facility registration certificate, not just company documentation.

Indonesia-Specific Logistics Considerations

Customs Clearance Process and Documentation

Indonesia's INSW (Indonesia National Single Window) coordinates Customs, Quarantine, BPOM, and Agriculture Ministry. Documents submit pre-arrival.

Clearance Channels:

Green Line (Jalur Hijau): Automatic clearance, 1-2 days

Yellow Line (Jalur Kuning): Document verification, 2-4 days

Red Line (Jalur Merah): Physical inspection, 3-7 days minimum

Food products face Red Line in 60-70% of cases. Sample testing can extend delays to 10-14 days.

Required Documents:

Commercial Invoice with correct HS code

Packing List

Bill of Lading / Airway Bill

BPOM ML Certificate (mandatory)

Halal Certificate from BPJPH (mandatory from October 2026)

Form E Certificate of Origin (ACFTA duty reduction)

Phytosanitary Certificate (fresh produce)

Import Approval (PI) for quota items

Insurance Certificate

One missing document triggers automatic Red Line. Form E must be issued before shipment departure for ACFTA benefits.

Critical Reminder: China Export Documentation Alignment

Many importers only discover the issue after customs clearance fails. The problem often originates at the port of loading, not the destination. Indonesia's Directorate General of Customs and Excise has entered an era of granular scrutiny for food products.

HS Code and Product Name Absolute Alignment:

Your Chinese supplier's product description on the Export Declaration (PEB - Pemberitahuan Ekspor Barang) must match word-for-word with your BPOM ML certificate.

Please note that Indonesia currently adopts the 8-digit HS code system under the BTKI 2022 standard. Chinese exporters must ensure that the first six digits align with global standards, while precisely matching the final two digits with Indonesia’s specific sub-classifications to avoid customs disruptions caused by digit-length discrepancies.

CIQ Code Chain Reaction:

All food exports from China require CIQ (Commodity Inspection and Quarantine) certification. Critical reminder to your supplier: the ingredient descriptions on the CIQ inspection certificate must align precisely with your BPOM registration documentation.

Any discrepancy between China-side documents and Indonesia-side filings results in Form E rejection, eliminating ACFTA tariff benefits. This creates thousands of dollars in unexpected duty charges that were not budgeted in your landed cost calculations.

Gerudo Logistics Solution: Before your container departs Chinese ports, we conduct pre-shipment document review to ensure China-side and Indonesia-side declarations are synchronized. This verification prevents Form E rejection and duty surprises at Jakarta customs.

Cold Chain Logistics for Indonesia Market

Major Port Infrastructure:

Tanjung Priok (Jakarta): Handles 60% of food imports. Most developed cold storage but regular congestion. Reefer power connection delays 2-6 hours during peak. Port temperature: 30-35°C year-round.

Critical Port Service: Due to extended queue times at Tanjung Priok, ensure your freight forwarder has pre-booked reefer plug-in positions at the terminal. Without advance reservation, containers can wait 6-12 hours for available power connections, creating significant temperature excursion risk.

Tanjung Perak (Surabaya): Better reefer capacity, less congestion. Recommended for temperature-sensitive cargo.

Belawan (Medan): Sumatra gateway, limited reefer infrastructure.

Indonesia-Specific Cold Chain Challenges:

Challenge 1: Tropical Climate Impact

Constant high temperatures create risk during every handling step. Container power disconnection during port moves exposes cargo to ambient heat. A 4-hour power interruption at 33°C raises internal temperature by 5-8°C.

Red Line inspection compounds this. Physical inspection requires opening containers for 6-10 hours in non-refrigerated conditions.

Real example: Frozen dim sum (-18°C) underwent Red Line inspection in Jakarta. 8-hour sample extraction raised temperature to -8°C. Entire shipment rejected by Indonesian quarantine.

Practical Sampling Strategy: Indonesian customs extracts samples by breaking original packaging during Red Line inspection. Recommended practice: Place 3-5 extra units near the container door specifically for customs sampling. This protects your primary cargo from packaging damage and allows inspectors easy access without disturbing deep-stacked pallets. Label these units clearly as "Sample for Inspection" in both English and Bahasa Indonesia.

Challenge 2: Port Infrastructure Gaps

Cold storage at Indonesian ports operates near capacity. "Held for inspection" cargo often sits in standard warehouses. Cold storage fees: $50-80/day when available. Container demurrage: $50-80/day.

Challenge 3: Inland Distribution

Cold chain often breaks at distribution level. Many Indonesian logistics providers use standard trucking, not refrigerated. Traditional markets lack cold storage.

Recommended Practices:

Enhanced insulation beyond standard reefer requirements

Pre-book port cold storage before shipment

Marine insurance with temperature deviation coverage

Consider Surabaya for less reefer congestion

Learn more about our specialized Cold Chain and Reefer Shipping Solutions for temperature-sensitive food imports.

For shipping methods and rates: Shipping from China to Indonesia

LCL (Less than Container Load) Risks for Food Imports

Many small and medium importers consider LCL shipping to reduce initial investment. However, LCL presents significant risks for food products in Indonesia that often outweigh cost savings.

Extended CFS Processing Time:

LCL cargo enters Indonesia's CFS (Container Freight Station) warehouses for deconsolidation. This process adds 5 to 10 days beyond FCL clearance time. During this period, your food products sit in shared warehouse space with other importers' cargo.

Temperature Control Breakdown:

Indonesian CFS warehouses typically operate at ambient temperature (30-35°C). Even if you shipped via reefer LCL, once cargo enters CFS for sorting, temperature control often breaks. Non-refrigerated warehouse conditions for 7-10 days significantly reduce product shelf life and quality for items like:

Seasonings with moisture-sensitive ingredients

Packaged snacks in heat-sensitive wrappers

Canned goods where high heat accelerates spoilage

Shared Liability Risk:

LCL shipments consolidate multiple importers' cargo under a single bill of lading. If any shipper in your consolidated container has documentation issues, Indonesian customs holds the entire container for inspection. Your compliant food products can become collateral damage, facing delays and additional storage fees despite having perfect documentation.

Increased Red Line Probability:

Indonesian customs assigns higher Red Line inspection rates to LCL shipments. The logic: consolidated cargo from multiple shippers presents higher risk than single-shipper FCL containers. Food products already face 60-70% Red Line rates. LCL increases this to approximately 80-85%.

When LCL Makes Sense for Food:

LCL remains viable only for:

Shelf-stable canned goods with 12+ month shelf life

Small test orders (under 5 CBM) where FCL economics don't work

Dry goods that tolerate ambient warehouse temperatures

For temperature-sensitive or time-critical food imports, FCL is strongly recommended despite higher per-shipment cost.

Read more for Indonesia Ocean Shipping container strategy FCL vs LCL.

Import Cost Structure and Calculation

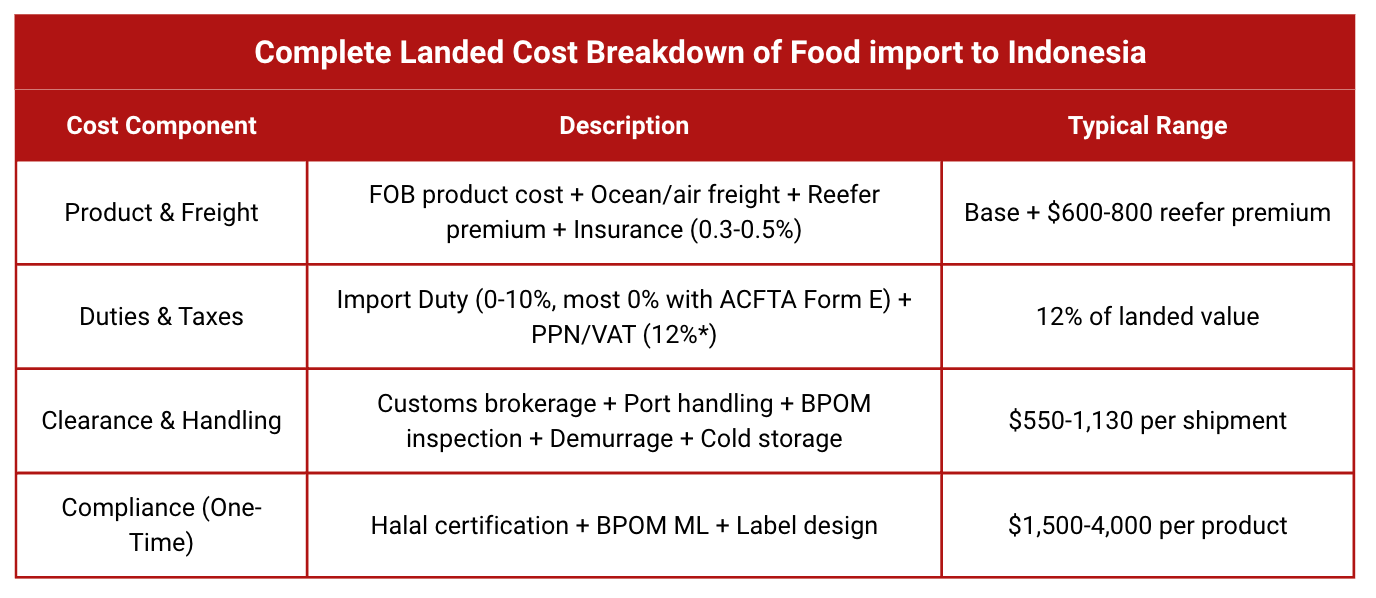

Complete Landed Cost Breakdown

Food import costs extend beyond FOB price. Accurate calculation requires multiple fee layers.

PPN Rate Note: Indonesia's VAT (PPN) is currently 12% as of 2025-2026. Subject to latest government notifications in early 2026. Importers should verify current rate with Indonesian customs authorities before finalizing cost calculations.

Impact on Profit Margins: The 12% PPN significantly affects landed costs and retail pricing. B2B buyers must account for this tax when preparing quotations to end customers. Failing to include PPN in pricing calculations results in margin erosion of 10-12 percentage points.

ACFTA Form E Benefits

Form E reduces duty to 0-5% for most food categories. Issued by Chinese CCPIT or CIQ.

Example: Frozen dim sum, 20ft reefer

CIF: $11,650

With Form E (0% duty): PPN = $1,398

Without Form E (10% duty): Duty + PPN = $2,703

Savings: $1,305 per container

Product Selection for Indonesia Market

1. Frozen Dim Sum (Halal-Certified)

Indonesian malls show strong demand for premium frozen dim sum. Middle-class consumers seek convenient quality frozen food.

Requirements: BPJPH Halal certification mandatory. GACC registration for meat + BPOM ML + cold chain. Timeline: 9-12 months. Profit margin: 40-60%.

2. White Garlic (Jinxiang, Shandong)

Indonesia is world's largest Chinese garlic importer. Consistent demand across retail and food service.

Requirements: RIPH permit + Phytosanitary Certificate. Timeline: 4-6 months. Volume-based business.

3. Food Additives (MSG, Citric Acid)

Indonesian manufacturers require steady additive supplies. HS Code 3824 accuracy critical.

Requirements: BPOM chemical registration (Medium risk). Timeline: 5-7 months. B2B focus.

4. Instant Noodle Seasoning

Supplies local noodle manufacturers. Halal certification essential for flavor sources.

Requirements: BPOM ML + BPJPH Halal. Timeline: 6-8 months. Bulk sales, 20ft minimum.

5. Canned Fruit (Pears, Peaches)

Indonesian dessert industry ("Es Buah") and HORECA demand. Lowest compliance barrier.

Requirements: BPOM ML (Low risk). Timeline: 3-4 months. Recommended entry product.

Implementation Timeline

Path A: Existing Importers Updating Compliance

Q1 2026 (January-March)

Audit products: identify Halal gaps, ML expiry dates, label updates needed

Submit Halal applications (4-6 month process)

Verify supplier GACC registration

Q2 2026 (April-June)

Renew expiring ML certificates (submit 3 months early)

Finalize Bahasa Indonesia labels

Test shipments with new documentation

Q3 2026 (July-September)

Clear old inventory before October 17

Transition to Halal-certified products

Verify complete documentation packages

October 17, 2026: Mandatory Halal enforcement

Path B: New Market Entrants

Month 1-2: Legal entity (PT PMA or partner). Obtain NIB and API-U.

Month 3-6: Submit BPOM ML applications. Begin BPJPH Halal process. Design compliant labels.

Month 6-9: Verify supplier GACC registration. Complete factory Halal audit. Finalize packaging.

Month 9-12: Book shipping with cold chain arrangements. Pre-arrange port storage. Submit documents via INSW.

Total: 10-12 months from start to first delivery.

Working with Gerudo Logistics for Indonesia Food Imports

Gerudo Logistics provides specialized China-Indonesia food import solutions with focus on dangerous goods and cold chain compliance:

China Production Hub Access: Guangzhou and Shanghai operations connect directly to major food manufacturing regions

Deep Indonesia Regulatory Expertise: Navigate LPPOM-MUI to BPJPH transition, BPOM ML registration support, and Form E processing

Cold Chain Infrastructure: Reefer container management, pre-booked port cold storage at Tanjung Priok/Tanjung Perak/Belawan, temperature monitoring systems

INSW Multi-Agency Coordination: Customs, Quarantine, BPOM, and Agriculture Ministry documentation and clearance management

Pre-Shipment Document Review: Verify China-side export declarations align with Indonesia-side import certificates before departure

One-Stop Customs Clearance Service: Complete door-to-door solutions handling all documentation, duties, taxes, and inland delivery for seamless import execution

Contact Gerudo Logistics for consultation on your 2026 Indonesia food import strategy.

Frequently Asked Questions For Food Importing from China to Indonesia

Q1: Is Halal certification mandatory for all food imports from China in 2026?

Yes. By October 17, 2026, all packaged food sold in Indonesia must carry BPJPH Halal certification. Non-Halal products require clear "Non-Halal" labeling. Products without proper certification face immediate rejection.

Q2: What is a BPOM ML number?

ML (Makanan Luar - Imported Food) is a registration number from BPOM required for every food product SKU before legal import. Different flavors or package sizes require separate ML numbers.

Q3: Can I ship food from China without a local Indonesian company?

No. You must have a PT or PT PMA with valid NIB and API-U to act as Importer of Record. Foreign entities cannot directly import.

Q4: How long does the BPOM registration process take?

Low risk products: 3-4 months. Medium risk: 5-7 months. High risk: 7-9 months. Registration must be completed before shipping.

Q5: What are the main ports for food imports in Indonesia?

Tanjung Priok (Jakarta) handles 60% of food imports with most developed infrastructure but faces congestion. Tanjung Perak (Surabaya) offers better reefer capacity with less congestion. Belawan (Medan) serves Sumatra distribution.

Q6: Does China have a trade agreement that reduces import duties to Indonesia?

Yes, under ACFTA. Form E Certificate of Origin from Chinese authorities (CCPIT or CIQ) reduces duties to 0-5% for most food products, saving $1,000+ per container.

Q7: What is the Red Line (Jalur Merah) in Indonesian customs?

Red Line means physical inspection and complete document review. Food products face Red Line in 60-70% of cases, adding 3-7 days minimum (10-14 days if sample testing required).

Q8: Are there import quotas on food products from China?

Yes. Garlic, certain fruits, and meat categories require RIPH (Recommendation for Import of Horticultural Products) and Import Approval (PI) from Ministry of Trade before shipping.

Q9: What language must food labels use?

All labels must be in Bahasa Indonesia, including product name, ingredients, nutritional facts, expiration date, and importer information. Labels must be part of original packaging, not post-arrival stickers.

Q10: What is the current VAT (PPN) rate for food imports in 2026?

Indonesia's VAT (PPN) is 12%, calculated on CIF value plus import duties. This applies to all imports regardless of ACFTA exemption. Critical: Include this 12% in pricing quotations to avoid 10-12 percentage point margin erosion.

Conclusion

Indonesia's October 17, 2026 mandatory Halal certification deadline requires immediate action from food importers. The 10 to 12 month setup timeline for new market entrants and the 4 to 6 month Halal certification process mean delays are no longer possible.

Success in Indonesia's food import market requires understanding the complete compliance framework: BPJPH Halal certification, BPOM ML registration, local entity requirements, and GACC verification. Cold chain logistics demand Indonesia-specific adaptations for tropical climate and port infrastructure constraints.

Working with experienced freight forwarders who understand both Chinese export procedures and Indonesian import regulations significantly improves compliance outcomes and reduces clearance delays.