Which Incoterm Is Best for Small Parcels Shipping from China? (EXW vs FCA vs DAP vs DDP Explained)

Why Incoterms Matter for Small Parcel Imports

You ordered 25 pieces of products and requested a FOB Sea shipping while your supplier said FOB is not suitable for a small quantity. What does that even mean? Why can't you use FOB like everyone talks about? And what's this EXW anyway—does that mean you need to arrange everything yourself?

This confusion costs money. In another common scenario, an importer orders 6 kg of cosmetics with what looks like a great DDP rate. The shipment clears customs smoothly, arrives at the customer's door—then the courier demands several hundred dollars in duties.

The "DDP" was not truly delivered duty paid. It was DAP with misleading terminology, and now you face an angry customer, potential refund demands, and a damaged business relationship.

This scenario occurs frequently in small parcel imports from China. When you import small orders, samples, Amazon replenishments, or e-commerce parcels from China, your logistics requirements differ fundamentally from traditional container freight operations. Small parcel shipments weighing between 1 and 20 kg typically move through:

Express courier services (DHL, FedEx, UPS)

Air special lines

Postal channels

The Incoterm you select determines who pays for freight, handles customs clearance, covers duties and taxes, and manages final delivery. An incorrect choice can result in:

Unexpected customs charges at destination

Shipments held in customs for extended periods

Recipients refusing delivery due to unanticipated fees

Significantly higher total landed costs than anticipated

Understanding which Incoterm aligns with your business model protects your profit margins and ensures smooth delivery operations.

Quick Incoterm Selection Guide Shipping Small Packages from China

For a comprehensive overview of the entire process, see our small parcels shipping guide from China.

The Best Incoterms for Small Parcels Shipping from China

EXW (Ex Works)

Best for: Sample orders or initial trial shipments

Under EXW terms, the seller makes goods available at their facility. The buyer assumes all transportation costs, export clearance responsibilities, freight charges, import duties, and delivery arrangements.

Advantages:

Lowest product price from supplier

Clear separation of responsibilities

Minimal seller involvement in logistics

Considerations:

Buyer must arrange export clearance in China

Requires logistics knowledge and established freight forwarder relationships

Buyer handles all documentation and compliance requirements

When to use EXW: First-time orders with new suppliers, product samples for evaluation, or situations where you maintain complete control over logistics through your established freight forwarder.

FCA (Free Carrier)

Best for: Buyers using established DHL, FedEx, or freight forwarder accounts

Under FCA terms, the seller delivers goods to a carrier nominated by the buyer at a specified location (typically the supplier's warehouse or a nearby carrier facility). The seller completes export clearance, then transfers responsibility to the buyer.

Advantages:

Seller handles export procedures

Buyer controls freight selection and pricing

Clear handover point reduces disputes

Works efficiently with courier account agreements

Considerations:

Buyer manages freight booking

Buyer pays all freight charges, import duties, and taxes

Requires coordination between buyer, seller, and carrier

When to use FCA: You maintain corporate shipping accounts with international couriers, you negotiate your own freight rates, or your business requires control over carrier selection and routing.

DAP (Delivered at Place)

Best for: B2B small shipments where the buyer manages customs clearance

Under DAP terms, the seller arranges and pays for transportation to the named destination. The buyer becomes responsible for import clearance, duty payment, and any unloading at the final destination.

Advantages:

Simple for seller to arrange shipping

Transparent freight costs included in quotation

Buyer retains control over customs clearance and duty payment

Clear division of responsibilities

Considerations:

Buyer must be prepared to pay duties and taxes upon arrival

Buyer needs customs clearance capability or broker relationship

Rejected deliveries can occur if buyer is unprepared for duty costs

When to use DAP: Your business has established customs clearance procedures, you prefer controlling duty payment timing and methods, or you work with a customs broker who handles clearance on your behalf.

DDP (Delivered Duty Paid)

Best for: E-commerce shipments, dropshipping, Amazon FBA, and B2C deliveries

Under DDP terms, the seller assumes all responsibilities and costs through final delivery. This includes export clearance, international freight, import duties and taxes, and delivery to the specified address.

Advantages:

Seamless delivery experience

No unexpected fees for recipients

Highest delivery success rate

Predictable total costs

Considerations:

Seller must manage tax compliance in destination country

Requires seller to understand import regulations

Higher initial quoted price reflects included duties

Some destinations require local importer of record

When to use DDP: You sell directly to consumers through e-commerce platforms, you operate dropshipping models, your business prioritizes customer experience and delivery success rates, or you ship to Amazon fulfillment centers.

Important warning about DDP for small parcels: Many suppliers quote "DDP" pricing that actually excludes duties and taxes—essentially providing DAP service with misleading terminology.

For specific guidance for ecommerce importers, explore our specialized resources on cosmetics, clothing, and electronics shipping from China.

Why FOB Is Usually Not Suitable for Small Parcels Shipping

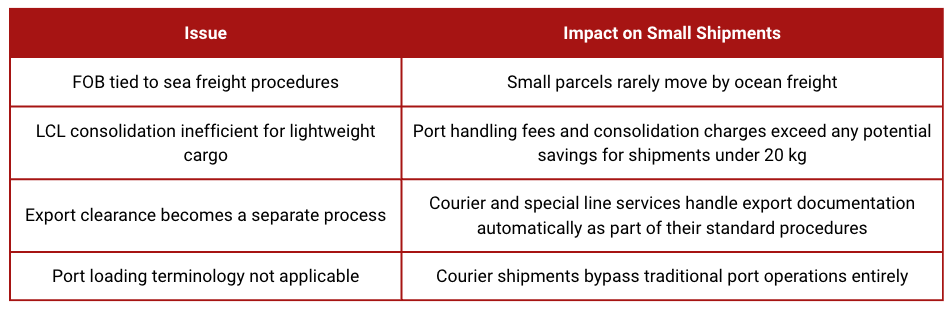

Many importers initially request FOB (Free On Board) pricing from suppliers. However, FOB creates practical complications for small parcel shipments.

FOB is designed specifically for ocean freight operations, not for express or courier services. The term references port loading procedures that are irrelevant to air shipments.

Limitations of FOB for Small Parcels

For shipments weighing 1 to 20 kg, FOB adds unnecessary operational complexity and increases costs rather than reducing them. Select an Incoterm designed for air transport or courier logistics instead.

When DDP Is Not Always Recommended When Shipping Small Packages from China

Certain destination markets enforce mandatory product registration requirements that can complicate DDP arrangements. In these situations, using DAP or FCA allows the local importer to manage compliance through their established regulatory channels.

Markets with Specific Registration Requirements

In Brazil, cosmetics are classified into Grade I (notification required) and Grade II (registration required) based on risk assessment. Foreign companies must work with a Brazilian Registration Holder who holds the appropriate ANVISA licenses. This regulatory framework makes DAP more practical than DDP for many cosmetic imports to Brazil.

Similarly, Saudi Arabia's SABER system requires product certification before import clearance proceeds. Working with a local importer who manages SABER compliance simplifies the process significantly

Recommended Shipping Methods for Small Parcels Under 20 kg

Selecting the right Incoterm works best when paired with the appropriate shipping method. For small parcel imports from China, ocean freight is rarely the optimal choice.

When NOT to Use Ocean Freight

Ocean freight (including LCL consolidation) is not cost-effective for:

Shipments under 100 kg

Orders requiring fast delivery (under 30 days)

Products with high value-to-weight ratios

Time-sensitive inventory replenishment

Port handling fees, minimum charges, and documentation costs for ocean freight typically exceed the freight cost itself when shipment weight falls below 100 kg. Transit times of 25-45 days also create cash flow challenges and inventory management complications.

Learn more about how to reduce shipping cost bulk orders vs small parcels

Optimal Shipping Methods for Small Parcels

Express Courier Services (DHL, FedEx, UPS)

Best for: 0.5-30 kg shipments

Transit time: 3-7 days

Advantages: Door-to-door tracking, automated customs clearance, high reliability

Works well with: FCA or DAP Incoterms

Cost range: Economical for time-sensitive shipments under 20 kg

Air Special Lines

Best for: 5-100 kg shipments where cost matters more than speed

Transit time: 7-15 days

Advantages: Lower cost than express courier, still faster than ocean

Works well with: FCA, DAP, or DDP Incoterms

Ideal for: E-commerce inventory replenishment, non-urgent restocks

Postal Services (China Post, EMS)

Best for: Very small shipments under 2 kg with flexible delivery timing

Transit time: 15-45 days

Advantages: Lowest cost option

Works well with: EXW or FCA Incoterms

Note: Limited tracking and higher loss rates

Practical Recommendation for First-Time Importers

If you're ordering your first small quantity from China:

Request FCA pricing from your supplier (they handle Chinese export clearance)

Select express courier or air special line based on urgency

Arrange pickup directly with the courier or through a freight forwarder

Prepare for import duties at destination (courier will contact you)

This approach avoids the complexity of EXW (where you must handle Chinese export procedures) and the unreliability of supplier-arranged DDP (where duties may not actually be included).

Working with a Professional Freight Forwarder to Reduce Risk in International Shipping

Businesses regularly shipping small parcels from China benefit significantly from partnering with an experienced freight forwarder who specializes in this segment. The right logistics partner makes a substantial difference in cost efficiency, delivery reliability, and regulatory compliance.

Gerudo Logistics provides transparent pricing, manages dangerous goods certifications when needed, and offers tailored logistics solutions for sample shipments and regular replenishment orders. We guide importers in selecting the appropriate Incoterm based on their specific business requirements, destination markets, and product characteristics, ensuring efficient customs clearance and cost-effective delivery.

FAQs for Small Parcel Incoterms & International Shipping from China

1. Why is FOB not suitable for small parcels?

FOB (Free On Board) is designed for ocean freight shipments with port loading procedures. Small parcels move by air courier or express services that bypass ports entirely.

2. Is DDP shipping legal from China?

Yes, DDP is legal when properly executed. The seller must correctly declare duties and taxes, ensure compliance with destination country import regulations, and either use a local importer of record or qualify as an importer in the destination country.

3. Does DDP mean I pay nothing on delivery?

Correct. Under genuine DDP terms, all duties and taxes are prepaid by the seller. Recipients should not face any charges upon delivery. If customs charges appear at delivery under what was quoted as DDP, the terms were not properly executed or were misrepresented as DDP.

4. What if my supplier refuses to offer DDP?

Use DAP or FCA instead. Many suppliers prefer not to handle destination country tax compliance and prefer terms where the buyer manages import duties. Working with your own freight forwarder under FCA or DAP terms gives you control over customs clearance and duty payment while still benefiting from reasonable freight rates.

5. Which Incoterm is best for Amazon FBA shipments from China?

DDP is optimal for Amazon FBA shipments. Amazon fulfillment centers are not equipped to handle customs clearance or pay duties. Shipments must arrive fully cleared and prepaid to avoid rejection at the warehouse. Air freight or air special line services under DDP terms provide the most reliable solution.

6. Can I use EXW as a beginner importer?

EXW is possible but challenging for new importers. You must handle export clearance procedures in China, which requires understanding Chinese customs requirements and having proper documentation. FCA is typically safer for beginners because the supplier completes export clearance before handover to your freight forwarder.

7. Are DAP shipments risky?

DAP works well when you understand your destination country's duty rates and have systems in place to pay them. The risk occurs if you are unprepared for the duty amount or lack proper customs clearance procedures. Working with a customs broker or freight forwarder who handles clearance eliminates most DAP-related challenges.

8. What happens if customs re-values my shipment?

Customs authorities may adjust declared values if they believe the stated amount does not reflect actual transaction value. When this occurs, duty calculations increase based on the higher assessed value. Always declare realistic transaction values and maintain documentation supporting your declared amounts, including commercial invoices and payment records.

9. How do I determine the duty rate for my product?

First, identify your product's HS (Harmonized System) code, which is a standardized international classification system. Then check the destination country's tariff schedule using that HS code. Many customs authorities provide online tariff lookup tools. Your freight forwarder can assist with HS code classification and duty rate determination.

10. Which Incoterm is most cost-efficient for small B2B orders?

FCA or DAP typically provides the best cost efficiency for B2B shipments to experienced importers. FCA works well when you have established freight forwarder relationships and can negotiate competitive rates. DAP works when the supplier can secure better freight pricing than you can independently. Compare quotations under both terms to determine which provides lower total landed cost for your specific situation.

Conclusion

Selecting the appropriate Incoterm directly impacts your costs, delivery reliability, and operational efficiency in small parcel logistics from China.

Key Takeaways:

DDP works best for e-commerce and B2C shipments

DAP or FCA suits B2B importers with customs clearance capabilities

EXW remains practical for sample shipments

Avoid FOB for parcels under 20 kg, it is designed for ocean freight

Proper Incoterm selection, combined with accurate product classification and compliance with destination requirements, positions your import operations for success. Understanding these trade terms reduces delivery failures, lowers total landed costs, and improves customer satisfaction.

Ready to optimize your small parcel shipping from China? Contact Gerudo Logistics for expert guidance on Incoterm selection, competitive freight rates, and specialized handling for your product category.