China to Europe Small Parcel Shipping 2026: Guide to New EU Customs Rules

The EU abolishes the €150 duty-free threshold on July 1, 2026, introducing a €3 fixed customs duty per HS code, mandatory IOSS registration (VAT system), and an additional €2 handling fee (November 2026). Every parcel from China now faces full customs processing regardless of value, affecting 40-50 billion packages annually.

Quick Executive Summary

Core Change: €150 duty-free threshold abolished July 1, 2026. Every parcel faces customs processing from first euro of value.

Financial Impact: Each parcel costs an additional €5-7 minimum (€3 fixed duty + €2 handling fee + VAT), before product-specific duties. A €50 product now costs €64.50 landed in Germany.

Survival Strategy: Register for IOSS before March 2026, verify all HS codes to avoid cargo holds, and consolidate same-category items to minimize the per-HS-code €3 duty multiplication.

B2C e-commerce platforms like Temu, Shein, and AliExpress will see the most significant impact. B2B importers handling small sample shipments or low-value orders will also face new cost structures and compliance requirements that demand immediate strategic adjustments.

This guide shows exactly what changes, how to calculate your new costs, and which operational changes you must complete before July 2026.

EU Customs Reform 2026: The End of the €150 Duty-Free Exemption

The EU customs reform removes the €150 de minimis threshold (old duty-free allowance for small packages). Under the old system, packages valued under €150 bypassed duties entirely, though VAT still applied.

What the Old System Allowed:

Packages under €150 entered duty-free

IOSS registration (VAT pre-collection system) was optional

Sellers could underdeclare values with minimal risk

Many parcels skipped full customs processing

What Happens Under 2026 Rules:

Starting July 1, 2026, every parcel from China faces full customs processing regardless of value. The core change introduces a flat €3 customs duty applied per tariff heading (HS code), not per parcel.

If you ship a package with one item category, you pay €3. If you ship three different product categories in one box, you pay €9 (€3 × 3 HS codes).

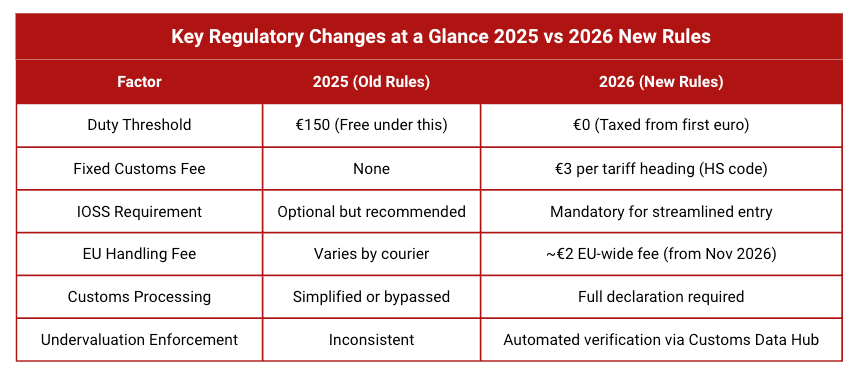

Key Regulatory Changes at a Glance

Implementation Timeline: When Each Fee Takes Effect

July 1, 2026:

€3 fixed duty per HS code goes live

€150 duty-free threshold officially ends

Full customs processing becomes mandatory

November 2026:

€2 EU-wide handling fee added

Total fixed costs increase to €5 minimum per parcel

Early 2026 (Country-Specific):

Romania and Netherlands may implement national handling fees before July

Some destinations cost more than others even before EU-wide system launches

The EU Customs Data Hub: AI-Driven Enforcement for Under-Valuation

The EU Customs Data Hub (automated system that cross-checks all declarations against historical data) connects directly to IOSS registrations, verifies declared values against market prices, and flags suspicious declarations for physical inspection (cargo hold that delays delivery 5-10 days).

If you declare a €50 smartphone as worth €10 to save on VAT, the AI system compares your price against thousands of similar smartphones and automatically triggers an inspection. Your cargo sits in customs for 5-10 extra days, and you may face penalties.

Landed Cost Analysis: How the €3 Duty Impacts Small Parcel Margins

The €3 flat duty sounds small until you calculate the compounding effect with VAT, handling fees, and the HS code multiplication factor (when multiple product categories trigger multiple €3 charges).

In our experience handling cross-border e-commerce shipments, most importers underestimate total landed costs by 15-20%. They only factor in the headline duty rate and forget about handling fees, the VAT on CIF value, and the per-HS-code penalty.

Real Cost Breakdown: Shipping a Single-Item Small Parcel to Germany

Consider a €50 facial cleansing device shipped from Shenzhen to Germany:

Cost Structure:

Product Value: €50

Import VAT (19% Germany): €9.50

Fixed Customs Duty: €3

EU Handling Fee (Nov 2026): €2

Total Additional Cost: €14.50 (29% of product value)

Your €50 product now costs €64.50 landed. If your product retails at €75, your margin drops from €25 to €10.50, a 58% reduction in gross profit.

The HS Code Multiplication Effect: Why Mixed Small Packages Cost More

The €3 duty applies per tariff heading (HS code), not per parcel. This creates a multiplication effect for mixed-category shipments.

Case Study: Multi-Category Package (€120 value)

A package contains three items:

Cotton t-shirt (HS 6109)

Plastic toy (HS 9503)

LED desk lamp (HS 9405)

Cost Breakdown:

Product Value: €120

Import VAT (19% Germany): €22.80

Fixed Customs Duty: €9 (€3 × 3 different HS codes)

EU Handling Fee: €2

Total Additional Cost: €33.80 (28% of product value)

The triple HS code classification triples your fixed duty from €3 to €9, even when all items ship in a single box with one tracking number.

Country-Specific VAT Rates: Location Matters

Import VAT rates vary significantly across EU member states:

VAT Rates by Major Markets:

Germany: 19% VAT

France: 20% VAT

Netherlands: 21% VAT + potential early national handling fee

Romania: 19% VAT + confirmed early national handling fee

Spain: 21% VAT

Italy: 22% VAT

A €100 parcel to Germany pays €19 VAT. The same parcel to Italy pays €22 VAT. Over 1,000 parcels, this 3% difference costs an extra €3,000 in VAT payments.

B2C vs B2B Impact Comparison

B2C E-commerce:

Faces full €3 + VAT + handling fee structure

Most platforms absorb costs to maintain competitive pricing

Margins compress by 20-30% on average

B2B Small Sample Shipments:

Follow standard tariff rates (not the flat €3 fee)

Lose the benefit of €150 duty-free threshold

A €100 sample that previously entered duty-free now pays full customs duties plus VAT

Small Parcel Compliance: Critical Actions Before July 1, 2026

Companies that delay IOSS registration (VAT pre-collection system) or continue using inaccurate HS codes will face delivery delays, unexpected fees, and penalties starting July 1.

IOSS Registration: Why It’s No Longer Optional for B2B Importers

The Import One-Stop Shop (IOSS) allows sellers to pre-collect VAT at checkout and remit it through a single monthly declaration. Under 2026 rules, IOSS becomes effectively mandatory.

What Happens Without IOSS:

Customs holds parcel and contacts courier

Courier pays customs duties and VAT on behalf of recipient

Courier adds service fee (typically €10-25) on top of duties and VAT

Recipient must pay courier before delivery

Many customers refuse delivery when faced with unexpected fees

Action Required: Initiate IOSS registration by March 2026 (process takes 4-6 weeks). Non-EU businesses need EU VAT number through intermediary/fiscal representative.

HS Code Classification: Critical Accuracy Requirements

Every product needs an accurate 6-digit or 8-digit HS code. The new Customs Data Hub (automated AI verification) performs real-time checking of HS codes against product descriptions.

What Misclassification Triggers:

Customs reclassifies your product to higher duty category

Physical inspection delays delivery by 5-10 business days

Repeated misclassification flags your account for enhanced screening on all future shipments

Common Classification Errors:

1. Generic "Electronics" Classification

Wrong: Classifying smartphone accessories under general "electronics"

Right: Specific accessory categories (phone cases, chargers, screen protectors have different HS codes)

Error can shift duties from 2% to 8%

2. Textile Blend Guesswork

60% cotton / 40% polyester has different HS code than 60% polyester / 40% cotton

Wrong classification triggers inspection and reclassification

3. Multi-Function Product Errors

Classify based on principal function (is lamp with Bluetooth mainly a lamp or mainly a speaker?)

Customs catches incorrect classification and reclassifies with penalty

Consult customs specialist before July 2026. The cost (typically €50-100 per product category) is minimal compared to systematic misclassification penalties.

Documentation Requirements Checklist

Every shipment requires complete documentation. Missing or incorrect paperwork triggers automatic customs holds (cargo stuck in warehouse until corrected).

Required Documents:

Commercial Invoice Must Include:

Accurate HS codes for each item

Detailed product descriptions (not generic "electronics")

Correct declared values matching actual transaction price

Complete seller and buyer information

IOSS VAT number

Packing List Requirements:

Itemized contents with quantities

Individual item values

Country of origin for each item

EORI Number:

Economic Operators Registration and Identification number (EU business registration system)

Required for both sender and recipient in B2B transactions

Product Compliance Certificates:

CE marking documentation for relevant categories

Safety test reports for electronics

Material composition certificates for textiles

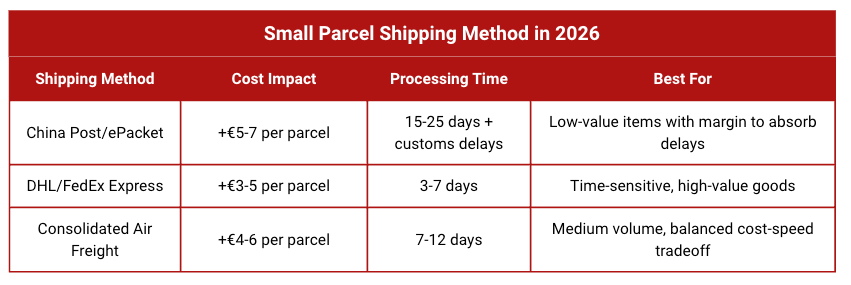

Selecting the Best Small Parcel Shipping Method in 2026

In our experience managing thousands of China-Europe shipments, carrier choice significantly impacts both cost and delivery time under 2026 rules.

Express Carriers (DHL, FedEx, UPS):

Offer integrated customs clearance services

Handle IOSS declarations automatically

Premium freight cost (30-40% higher than postal) offset by faster clearance and lower customer delivery refusal rates

Consolidated Air Freight:

Multiple shippers' parcels combine into larger shipments

Receive priority customs processing

Best for sellers shipping 50+ parcels weekly

Packaging Strategy Under New Rules

The old strategy of splitting orders into multiple small packages no longer works. This approach now increases costs because each package pays the €2 handling fee separately.

Optimal 2026 Packaging Strategy:

Consolidate Items by HS Code:

If customer orders three items from same HS code, ship together in one package

Pay one €3 duty instead of three separate €3 duties

Mixed HS Code Packages:

Consolidating different HS codes into one package does NOT reduce the €3-per-HS-code duty

Only savings come from reduced shipping fees and single €2 handling fee

Package Size Optimization:

European customs bases VAT on CIF value

Higher shipping costs = higher VAT you pay

Use appropriately sized packaging to reduce dimensional weight charges (pricing based on package size rather than actual weight)

2026 Product Selection: High-Margin Trends for Small Parcel Shipping

The €3 duty plus €2 handling fee plus VAT creates a fixed cost floor of approximately €5-7 per parcel. This reality eliminates profitability for many low-value products.

Successful products in 2026 share three characteristics:

Sufficient margin to absorb €5-7 in fixed costs

Fall under single HS code to avoid multiplication effect

Offer enough perceived value that customers willingly pay duty-inclusive prices

Top Recommended Small Parcel Categories for the Post-Exemption Era

Beauty Tech (Facial Cleansing Devices, LED Masks)

Products typically sell for €40-80 retail with 50-60% margins. A €50 facial cleansing device absorbs the €14.50 in duties and fees while maintaining €10+ profit margin. Consumer demand remains strong because customers view beauty tech as premium wellness products.

Smart Home Devices (Wi-Fi Smart Sockets, LED Controllers)

Combine compact size (low shipping costs) with high perceived value. A €25 smart socket costs €5-6 to ship and pays €8-9 in duties and fees, but retails for €45-50. The "smart living" trend supports premium pricing.

Wireless Electronics (Earbuds, Portable Chargers, GaN Chargers)

High-quality wireless earbuds retail for €60-100, easily absorbing the new cost structure. GaN chargers (Gallium Nitride fast chargers, 65W+) sell for €35-50 and offer differentiation from standard chargers.

Fitness Accessories (Resistance Bands, Yoga Mats)

Lightweight (low shipping costs), consumable or regularly replaced (repeat purchases), and often sold in sets (multiple units under one HS code). A set of resistance bands sells for €30-40, absorbs €10 in costs, and maintains healthy margins.

Mobile Accessories (Phone Cases, Screen Protectors)

Premium mobile accessories with unique designs command prices that cover new costs. A €35 premium leather case with card slots maintains profitability, while a €15 basic case struggles.

Low-Value Small Parcel Items to Avoid Under the New Fee Structure

Low-Value Commodity Items (Priced Under €10 Retail)

Cannot profitably absorb €5-7 in fixed costs:

Basic phone cables priced under €8

Generic clothing items priced under €15

Commodity household items (sponges, brushes) priced under €12

Fashion jewelry priced under €10

Generic Products with Thin Margins (15-20%)

Face compression to breakeven or loss when €5-7 fixed costs apply.

Products Requiring Multiple HS Codes

Single orders that trigger multiple €3 duties destroy unit economics.

The market shifts toward fewer SKUs at higher price points rather than broad catalogs of low-priced items.

How Gerudo Logistics Supports Your 2026 Small Parcel Shipping

DDP (Delivered Duty Paid) Service: We handle all customs duties, VAT, and handling fees. You pay us a single landed cost. Your European customers receive parcels with no additional fees at delivery, eliminating the 20-30% delivery refusal rate we see when customers face unexpected courier fees.

IOSS Registration: We assist with fiscal representative coordination, VAT number acquisition, integration with your e-commerce platform, and monthly VAT declarations across all 27 EU member states.

HS Code Classification: Our customs specialists classify products according to EU Combined Nomenclature. For product lines with 50+ SKUs, we conduct bulk classification (typically €2,000-3,000) that prevents ongoing clearance delays and penalties.

Consolidated Air Freight: We operate consolidated services from Guangzhou, Shenzhen, and Shanghai to major European airports. For 100+ parcels weekly, our dedicated consolidation service collects at your warehouse, pre-sorts by destination, and coordinates single customs declarations for shipment groups.

Real-Time Tracking: See exactly when parcels enter customs, when duties are paid, and when clearance completes. Early warning alerts notify you of potential delays.

Frequently Asked Questions for China-Europe Small Parcel Shipping

Q: When does the new €3 customs duty take effect?

A: The fixed €3 customs duty starts July 1, 2026. An additional €2 EU handling fee begins in November 2026. Some countries like Romania and the Netherlands may implement national handling fees earlier.

Q: Is the €3 fee per parcel or per item?

A: The fee applies per tariff heading (HS code). If one package contains three items from different HS code categories, you pay €9 total (€3 for each category). Items from the same HS code in one package pay only one €3 fee.

Q: Does the €3 duty replace VAT?

A: No. Import VAT remains mandatory at rates of 17-27% depending on destination country. The €3 duty is an additional charge on top of VAT.

Q: How do I pay these new duties?

A: For e-commerce orders, duties are collected at checkout through the IOSS system when the seller is registered. Without IOSS registration, the courier pays customs on your behalf and charges you upon delivery, typically adding a €10-25 service fee.

Q: Can I avoid the fee by splitting orders into smaller boxes?

A: No. Splitting shipments increases total costs because each package pays the €2 handling fee separately. Consolidation saves money under new rules.

Q: Will this affect shipping times?

A: Expect initial delays in July-August 2026 as customs authorities adjust. Shipments with complete IOSS registration and accurate HS codes clear faster. Typical processing may extend from 1-2 days to 3-5 days during transition period.

Q: What is the EU Customs Data Hub?

A: A centralized digital platform launching in 2026 that manages e-commerce data and automates duty calculations across all 27 EU member states. The system verifies declared values, checks HS code accuracy, and flags suspicious declarations.

Conclusion

The 2026 EU customs reform adds €5-7 minimum cost per parcel before product-specific duties. Successful adaptation requires immediate action:

Four Critical Steps:

Audit product catalog - Eliminate items with insufficient margin, focus on products priced above €25 retail with 40%+ margins

Initiate IOSS registration by March 2026 - Process takes 4-6 weeks, requires fiscal representative for non-EU businesses

Verify HS codes for all active SKUs - Invest in professional classification for complex products, document classification rationale

Test DDP shipping solutions - Evaluate consolidated air freight for medium volumes (50-100+ parcels weekly), consider express carriers for time-sensitive goods

Companies that delay these preparations will face compressed margins, delivery delays, and customer satisfaction problems starting July 1. The window for proactive adjustment closes rapidly as spring 2026 approaches.

Gerudo Logistics offers comprehensive DDP solutions, IOSS registration support, and expert customs classification for China-Europe small parcel shipping. Contact us to prepare your 2026 logistics strategy.