Battery-Powered EV Import from China: What You Must Know in 2026

Shipping electric vehicles from China changed on January 1, 2026 when IMDG Code Amendment 42-24 became mandatory. The new regulations introduced specific classification requirements affecting every EV shipment. Importers who understand these changes avoid costly delays. Those who do not face rejected bookings and shipments stuck at Chinese ports.

The shift from generic UN 3171 to chemistry-specific UN 3556, UN 3557, and UN 3558 classifications means carriers scrutinize EV shipments more carefully. State of Charge verification, enhanced battery documentation, and carrier approval processes determine whether your vehicles ship on schedule or sit in storage while you fix paperwork.

This guide addresses the specific dangerous goods compliance requirements for shipping electric vehicles from China in 2026, covering UN classification, RoRo versus container shipping decisions, State of Charge requirements, and complete documentation packages.

Can Electric Vehicles Be Shipped from China in 2026?

Yes, electric vehicles ship from China via ocean freight under dangerous goods regulations due to lithium-ion battery systems.

Why EVs Are Classified as Dangerous Goods

A standard EV battery pack stores 50-100+ kilowatt-hours of energy - equivalent to approximately 1.5-3 gallons of gasoline in energy content. If thermal runaway occurs during transport, these batteries can release energy rapidly, creating fires difficult to extinguish on vessels.

The International Maritime Organization classifies battery-powered vehicles as Class 9 Miscellaneous Dangerous Goods. This triggers specific requirements: battery documentation proving safety testing, State of Charge limitations to reduce fire risk, enhanced packaging and securing requirements, carrier approval before booking, and emergency response procedures during transit.

For comprehensive details on battery Shipping and documentation, see our guide on shipping lithium battery products from China.

What Changed After IMDG Code Amendment 42-24

IMDG Code Amendment 42-24 became mandatory January 1, 2026. The previous system used generic UN 3171 classification for all battery-powered vehicles. The new system introduces chemistry-specific classifications: UN 3556 for lithium-ion, UN 3557 for lithium metal, and UN 3558 for sodium-ion battery vehicles.

UN 3171 is no longer permitted for lithium or sodium-ion battery-powered vehicles in maritime transport under IMDG 42-24. Air transport transitioned earlier, with IATA requiring new classifications from March 31, 2025.

What This Means for Importers

Every commercial invoice must reference correct UN numbers based on battery chemistry. Dangerous goods declarations require specific battery details including chemistry type, watt-hour rating, and UN 38.3 test references. Shipments declared as UN 3171 are likely to be rejected by carriers.

State of Charge requirements became stricter. Carriers verify batteries are discharged to 30% or less with signed documentation, not verbal confirmations. The approval process takes longer - allow 2-3 weeks for booking during normal seasons, 4-6 weeks during peak periods (September-November).

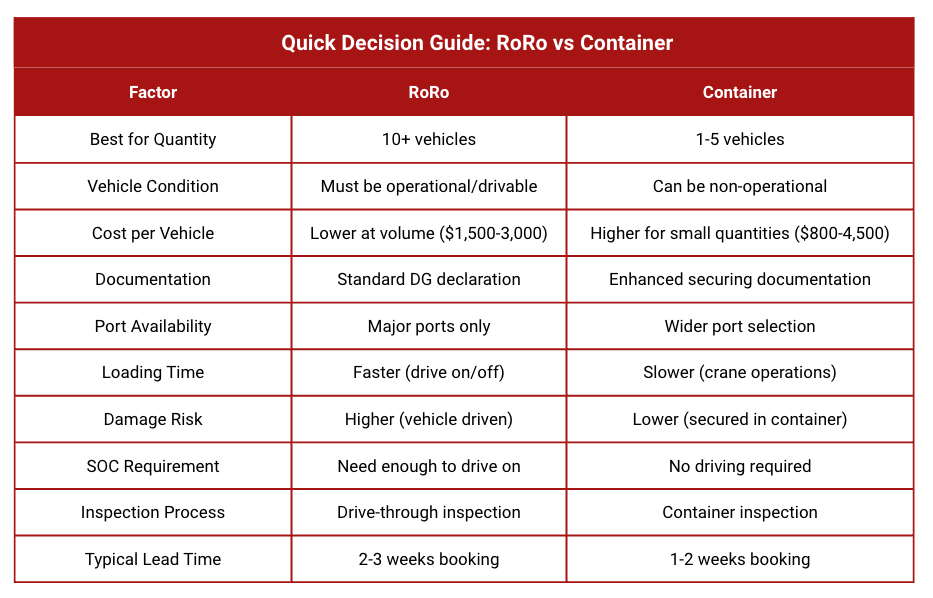

How Importers Usually Ship EVs from China: RoRo and Container

RoRo Shipping: Specialized car carriers where vehicles drive aboard. Major carriers: NYK Line, Höegh Autoliners, Wallenius Wilhelmsen, Glovis. Best for operational vehicles, 10+ units, and destinations with RoRo terminals (Los Angeles, Hamburg, Dubai, Sydney). Vehicles must be drivable with sufficient charge to board while meeting 30% SOC maximum. Note: vehicles driven on/off have higher risk of minor damage (scratches, bumps) versus container shipping.

Container Shipping: Vehicles placed in 20ft or 40ft containers (1-2 EVs per 40ft). Best for non-operational vehicles, 1-5 vehicles, destinations without RoRo service, and enhanced damage protection. Vehicles remain secured inside containers throughout transit, minimizing movement and damage risk.

Where Most EV Shipments from China Fail

Most rejections happen during booking review or terminal inspection.

Failure 1: Wrong UN Classification (Using UN 3171)

Carriers are likely to reject bookings using UN 3171. IMDG 42-24 phased this out on January 1, 2026. Bookings sit in review 3-5 days before rejection. During peak season, this adds 2-3 weeks.

Prevent: Verify battery chemistry. Lithium-ion batteries use UN 3556. Ensure documents reference UN 3556, not UN 3171.

Failure 2: SOC Documentation Missing

Vehicles arrive without written State of Charge verification, or SOC shows 60-80% charge. Carriers require 30% or less with signed documentation. Terminal is likely to reject vehicles. This adds 1-2 weeks plus $1,000-2,000 in fees.

Prevent: Establish SOC procedures early. Require written verification with all data fields. Discharge to 20-30% at least 48 hours before port. Transport on flatbed trucks to preserve charge.

Failure 3: Missing UN 38.3

Suppliers cannot provide UN 38.3 test summaries, or summaries are outdated (over 5 years) or cover wrong battery models. Carriers typically reject bookings. UN 38.3 certification takes 4-6 weeks minimum.

Prevent: Request UN 38.3 during quotation before placing orders. Verify exact battery model match. Check dates within 5 years.

Failure 4: Supplier Lacks DG Certification

Supplier cannot sign Dangerous Goods Declaration. This costs $200-500 for freight forwarder signing and adds 3-5 days. On tight schedules, you miss departure and must rebook.

Prevent: Ask suppliers: "Can you sign DG declarations for UN 3556?" If not, engage China-based freight forwarder with DG expertise from start.

Prevention costs hours of verification. Failed shipments cost 2-4 weeks and $1,000-2,000+ in fees.

Cost and Transit Time from China: Complete Budget Planning

Complete Cost Breakdown 2026 January

Ocean Freight (primary cost):

RoRo: $1,500-3,000 per vehicle depending on destination

Container: $800-4,500 per vehicle depending on quantity per container

Additional Costs:

DG documentation fees: $200-500 (if supplier lacks certification)

China export customs clearance: $150-300

Port handling and documentation: $100-250

Marine insurance: 1-2% of vehicle value (typically $150-300 per vehicle)

Destination customs clearance: $200-600

Port delivery and handling: $150-400 per vehicle

Import duties: varies by country (USA varies by vehicle type, EU typically 10%, Middle East 5-15%)

Hidden Costs When Things Fail:

Rejected booking rebooking fees: $300-500

Port storage while fixing documentation: $50-150 per day per vehicle

Emergency SOC discharge and documentation: $200-400 per vehicle

Redelivery to terminal after rejection: $150-300 per vehicle

Real Cost Example: One EV Shanghai to Los Angeles via RoRo

Vehicle FOB price: $25,000

RoRo ocean freight: $1,800

DG documentation (supplier lacks cert): $300

China export clearance: $200

Marine insurance (2%): $500

US customs clearance: $400

Port delivery Los Angeles: $250

Total landed cost: $28,450

Transit Time Expectations

Port-to-Port Ocean Transit:

Shanghai to Los Angeles: 14-18 days

Shanghai to New York: 28-32 days

Shanghai to Hamburg: 28-35 days

Shanghai to Dubai: 18-22 days

Shenzhen to Sydney: 16-20 days

Complete Door-to-Door Timeline:

Supplier to port transport: 1-2 days

Terminal inspection and loading: 2-3 days

Ocean transit: 14-35 days (route dependent)

Destination customs clearance: 3-7 days

Final delivery from port: 2-5 days

Total: 3-7 weeks for most routes

Planning Buffers (add to timeline above):

Normal season with experienced suppliers: add 1 week buffer

Peak season (September-November, Chinese New Year): add 2-3 weeks buffer

First-time suppliers or complex documentation: add 2-4 weeks buffer

If UN 38.3 testing needed: add 4-6 weeks before shipping can begin

Peak Season Impact: Chinese New Year (typically late January-February) and pre-Christmas rush (September-November) add $500-1,500 per vehicle in surcharges. Booking lead times extend from 2-3 weeks to 4-6 weeks due to capacity constraints. Book 6-8 weeks in advance during these periods. Confirm bookings in writing with specific vessel names and sailing dates.

What Importers Should Prepare vs What Forwarders Handle

Clear responsibility division prevents gaps where critical tasks fall through cracks.

Importer Responsibilities in EV Shipping

Battery Documentation from Supplier:

Obtain UN 38.3 test summary for exact battery model, Battery SDS with Section 14 referencing IMDG Code Amendment 42-24, and battery specifications showing chemistry type (lithium-ion, lithium metal, or sodium-ion), watt-hour rating in kWh, and voltage details.

Request these documents during quotation stage to identify potential delays early. Suppliers who primarily serve domestic Chinese markets often need 2-4 weeks to compile proper export documentation.

SOC Management Coordination:

Coordinate discharge of vehicle batteries to 20-30% at least 48 hours before port delivery.

Obtain written SOC verification with all required data fields including battery capacity, SOC percentage, verification date/time, method used (vehicle diagnostics system), technician signature, and supplier company seal.

Confirm vehicles will be transported on flatbed trucks to port rather than driven to preserve documented charge states.

Vehicle Specifications and VIN Documentation:

Provide accurate VIN (vehicle identification number) for each unit, make/model/year, complete battery specifications (capacity in kWh, chemistry type), total vehicle weight including battery, and declared customs value for insurance and import purposes.

Specification errors often cause terminal rejections. VIN mismatches between paperwork and vehicle typically result in rejection.

Destination Import Requirements: Research and prepare destination country requirements.

USA requires DOT safety compliance and EPA emissions certification (even for electric vehicles).

European Union requires type approval certification and CE marking. Middle East countries may require GCC standardization certificates.

Australia requires compliance with ADR (Australian Design Rules).

You are responsible for ensuring vehicles meet destination technical standards and securing required certifications.

Carrier and Method Selection:

Decide between RoRo and container shipping based on vehicle condition, quantities, and budget.

Review carrier acceptance criteria for UN 3556 shipments as different carriers have different battery capacity limits and SOC verification standards.

Confirm destination port has infrastructure to receive your chosen shipping method (not all ports have RoRo terminals).

What Freight Forwarders Handle in EV Shipping

Dangerous Goods Declaration Preparation: Experienced freight forwarders prepare and sign UN 3556 dangerous goods declarations with proper classification based on battery chemistry, packing instruction references (P912 for vehicles), emergency response information and contact details, and compliance statements referencing IMDG Code Amendment 42-24.

Freight forwarders with dangerous goods certification can sign these declarations even if your supplier lacks certification. This service typically costs $200-500 per shipment and eliminates a major potential failure point.

Carrier Booking and Documentation Submission: Submit dangerous goods bookings to carriers, coordinate with carrier DG acceptance teams on documentation review, track booking approval status and notify you of issues requiring resolution, and confirm vessel sailing dates and space allocation.

The booking approval process for UN 3556 shipments takes longer than standard cargo bookings. Freight forwarders who specialize in dangerous goods have established relationships with carrier DG departments which can expedite approval.

Export Customs Clearance and Port Coordination: Handle China export customs documentation, arrange transport from your supplier facility to departure port, coordinate terminal delivery appointments and gate-in procedures, manage terminal inspections and address documentation issues that arise, track loading onto vessels and obtain Bill of Lading, and monitor vessel departure and transit.

If terminal inspectors identify problems during gate-in inspection, freight forwarders with dangerous goods expertise can often resolve issues on-site rather than rejecting vehicles and requiring redelivery.

Red Flags to Watch

Supplier says "we handle everything, you do not need a forwarder": Suppliers may handle domestic logistics but rarely manage international dangerous goods compliance. Documentation gaps often emerge at port without forwarder oversight.

Shipping quotes 30-40% below market rates: Suggests supplier unfamiliar with dangerous goods surcharges and documentation fees. Surprise costs appear later.

Supplier dismisses SOC requirements as not necessary" or "too complicated": SOC verification is mandatory. Suppliers resisting this lack export procedures and are likely to cause terminal rejections.

Supplier cannot provide UN 38.3 but promises "we can get them quickly": UN 38.3 testing requires 4-6 weeks minimum. Suppliers without current test summaries cannot expedite this process regardless of promises.

Work with suppliers and freight forwarders who acknowledge dangerous goods compliance requirements upfront. Their transparency indicates experience and realistic planning.

Understanding the New UN 3556 Classification

Your vehicle's UN number depends on battery chemistry:

UN 3556 (lithium-ion - most commercial EVs including BYD, NIO, XPeng, Geely)

UN 3557 (lithium metal - rare, mainly prototypes)

UN 3558 (sodium-ion - emerging chemistry, small market segment).

Verify Chemistry: Request battery specs from supplier. Look for lithium-ion, Li-ion, LFP, or NMC - all use UN 3556. Check Battery SDS Section 14 for correct UN number. If SDS shows UN 3171, it's outdated.

Shipping Documents: Commercial invoice includes UN classification, shipping name "Vehicle, Lithium Ion Battery Powered," capacity in kWh. Packing list shows VIN, UN number, watt-hour rating. DG Declaration states UN 3556, Class 9, P912 packing instruction, SOC verification.

Every document must specify exact UN number matching battery chemistry. Classification errors are typically rejected. See our IMDG 42-24 guide for details.

State of Charge (SOC): The 30% Rule Explained

A standard EV battery stores 50-100+ kilowatt-hours - roughly equivalent to 2.5 gallons of gasoline in energy. If thermal runaway occurs, a fully charged battery creates larger, hotter fires than partially discharged batteries. IMO guidance recommends 30% SOC or less to reduce fire risk.

SOC Requirements

Ocean freight recommends 30% or less (some carriers accept up to 50% with enhanced documentation). RoRo vessels typically require 30-50% (upper limit because vehicles must drive onto vessels). Air freight enforces strict 30% maximum.

How to Manage SOC in EV Shipping

Coordinate discharge one week before port delivery using vehicle onboard functions or controlled driving. Stop at 20-30% to maintain safety margin. Complete discharge 48+ hours before delivery to allow stabilization. Document with battery capacity (kWh), exact SOC percentage, verification date/time, method used, technician signature, and company seal. Transport vehicles on flatbed trucks to port (not driven) to preserve charge state.

Common Mistakes to Avoid

Verbal confirmation without documentation (terminal rejection). Handwritten notes without company seals (carriers question authenticity). Chinese language only (requires English translation). Generic statements like SOC is low (carriers demand precise measurements). Undated documentation (cannot verify if current).

Provide suppliers with clear SOC documentation templates. Review completed documents before terminal delivery while correction is still possible.

How Gerudo Logistics Supports EV Shipments from China

Shipping battery-powered vehicles from China requires specialized dangerous goods expertise beyond standard freight forwarding.

Our DG Compliance Services: We prepare and sign UN 3556 declarations meeting carrier standards, coordinate UN 38.3 verification with Chinese suppliers, review Battery Safety Data Sheets for IMDG 42-24 compliance, and manage complete documentation packages for carrier review.

SOC Management: Work directly with Chinese suppliers to establish discharge procedures, provide carrier-compliant documentation templates, coordinate discharge timing with vessel schedules, verify documentation completeness before terminal delivery, and resolve SOC issues during inspection.

Carrier Relationships: Established relationships with major RoRo carriers and container lines provide priority booking during peak seasons, expedited dangerous goods review, and direct communication with carrier DG teams. We handle booking submissions, track approvals, manage schedule changes, and secure space for time-sensitive shipments.

China Port Operations: Operations across Shanghai, Shenzhen, Guangzhou, Ningbo, and Tianjin coordinate supplier-to-port transport, manage terminal delivery and gate-in procedures, provide on-site support during inspections, resolve documentation issues before rejections, and monitor loading operations.

During booking review, carriers typically reject incomplete DG declarations or outdated classifications. Our DG specialists understand current requirements, packing instructions, and carrier criteria.

Bookings clear review in 3-5 days versus 1-2 weeks for standard submissions. At terminal inspection, our China-based teams work directly with port DG officers, resolving issues on-site and reducing the likelihood of vehicle rejection.

Frequently Asked Questions: Shipping EVs from China in 2026

Can electric vehicles be shipped from China by sea?

Yes. EVs ship via RoRo or container under UN 3556 (lithium-ion) or UN 3557/3558. Requires battery documentation, 30% SOC verification, and carrier DG approval.

What UN number applies to electric vehicles in 2026?

Lithium-ion vehicles use UN 3556, lithium metal use UN 3557, sodium-ion use UN 3558. UN 3171 is no longer permitted as of January 1, 2026. Bookings using UN 3171 are likely to be rejected.

What causes carriers to reject UN 3556 EV bookings?

Incorrect UN classification (using UN 3171), incomplete battery documentation, missing SOC verification, or improper DG declaration signatures. Most rejections occur during booking review.

RoRo vs container shipping: which is better?

RoRo works best for 10+ operational vehicles ($1,500-3,000 each). Containers suit 1-5 vehicles or non-operational units ($800-4,500 each). Break-even typically occurs around 5-8 vehicles.

How long does it take to ship EVs from China?

Ocean transit: 14-18 days (China-USA West Coast) to 28-35 days (China-Europe). Total timeline: 5-8 weeks including documentation, booking, transit, and customs. Add 2-3 weeks for peak season.

When did the UN classification change take effect?

IMDG Code Amendment 42-24 became mandatory January 1, 2026, introducing UN 3556/3557/3558. UN 3171 was phased out for lithium/sodium-ion vehicles.

Conclusion:

Shipping electric vehicles from China involves significantly more complexity than conventional automotive exports due to dangerous goods regulations. The presence of lithium-ion battery systems means every EV shipment must comply with UN 3556 classification requirements, State of Charge limitations, comprehensive battery documentation standards, and carrier-specific acceptance criteria.

Success requires recognizing from the start that EVs are dangerous goods, not ordinary vehicles. Work with Chinese suppliers who understand SOC management and documentation requirements. Choose freight forwarders with dangerous goods certification who can prepare compliant declarations and coordinate with carriers experienced in battery-powered vehicle transport.

At Gerudo Logistics, we help importers navigate the complete dangerous goods compliance process for electric vehicle exports from China. Our dangerous goods specialists understand both the regulatory requirements and the practical operational challenges that arise when shipping battery-powered vehicles internationally.

Ready to export electric vehicles from China with confidence? Contact our team for expert guidance on your EV shipping requirements.