Chilled vs Frozen: Choosing the Right Mode for Seafood Shipping from China to Europe

Here's the thing nobody tells you upfront: most importers who contact us already know they want to ship seafood from China to Europe. What they don't know is whether their product should go frozen or chilled. And that's where things get messy.

Last month, we had a client insist on air-freighting "fresh" tilapia fillets from Ningbo to Amsterdam. Premium positioning, they said. Higher margins. The problem? By the time we calculated air freight rates, specialized packaging, and expedited customs clearance, their landed cost was 8 times higher than frozen ocean freight. Their European buyer wasn't willing to pay anywhere near that premium. The shipment never happened.

This decision, chilled or frozen, shapes everything else. Your transport method, budget, timeline, and whether your seafood arrives in condition to sell. Let's break down how to make the right call.

Why the Choice Matters

Transit time is your first reality check.

Sea freight from China to Europe takes 30-45 days port-to-port. Add inland transport, customs clearance, and final delivery, and you're looking at 35-50 days total. For most seafood, this timeline makes frozen transport the only viable option, chilled seafood has a shelf life measured in days, not weeks.

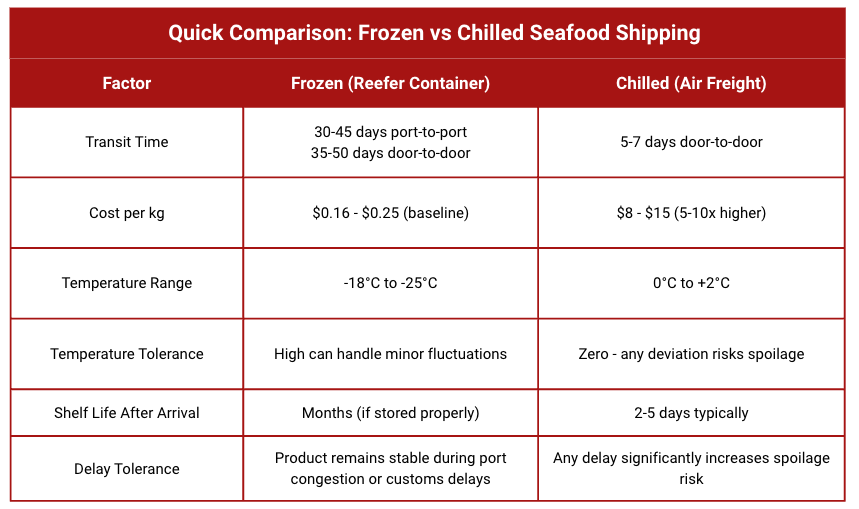

Cost structures differ dramatically:

Frozen: Standard reefer containers at predictable freight rates, established cold chain infrastructure, manageable insurance premiums

Chilled: Expensive air freight (5-7 days but 5-10x higher costs per kg), specialized packaging, tighter handling requirements, higher risk premiums

Market positioning drives profitability. European buyers have different expectations depending on product category:

Commodity items (frozen shrimp blocks, tilapia fillets, squid tubes): buyers expect frozen delivery

Premium products (sashimi-grade tuna, live shellfish): "fresh, never frozen" commands significant price premiums, but only if delivered in perfect condition

One more thing people underestimate: operational complexity. Frozen shipments are forgiving. If container stuffing takes an extra hour, if there's a minor temperature fluctuation during transit, if customs clearance takes two days instead of one, your product usually survives intact. Chilled products demand perfection. Every step must execute flawlessly or you lose the shipment.

Quick Comparison: Frozen vs Chilled Seafood Shipping

Frozen Seafood: The Industry Standard for Shipping from China to Europe

Walk into any Chinese seafood processing plant that exports to Europe, and you'll see blast freezers running at -35°C, cold storage warehouses at -25°C, and loading bays designed for rapid container stuffing. The entire infrastructure is built around frozen.

Temperature and Monitoring

Under EU Regulation 853/2004 (specifically Annex III, Section VIII, Chapter VII), frozen fishery products must be kept at a temperature "not more than -18°C in all parts of the product" with possible short upward fluctuations of not more than 3°C during transport. This is the legal requirement across all EU member states.

In practice, most reefer containers ship seafood at -18°C to -25°C depending on product:

Standard frozen shrimp, squid, tilapia: -18°C to -20°C

Premium tuna blocks: -25°C for maximum quality retention

Whole mackerel or sardines: -18°C is sufficient

Temperature monitoring isn't optional. You need:

Reefer container unit logs (built into the container)

Independent data loggers placed inside the cargo (these are separate devices that record temperature every hour or even every 15 minutes)

Pre-cooling certificates showing the container reached setpoint before loading

Loading temperature records from the Chinese cold storage facility

We've seen containers rejected at Rotterdam BCP because the data logger showed a 6-hour period where temperature rose to -12°C during container stuffing in Qingdao. That's above the allowable fluctuation. The entire container got flagged for additional inspection, delayed for three days, and the importer incurred extra cold storage fees at the port.

Products That Move Frozen from China to Europe

Shrimp dominates. Vannamei (whiteleg shrimp) in every format, head-on shell-on (HOSO), head-less shell-on (HLSO), peeled and deveined (PD), peeled undeveined (PUD), plus breaded and value-added versions. China is one of the main extra-EU suppliers of frozen shrimp to European markets.

Whitefish is huge: Tilapia fillets (skinless, boneless, individually vacuum packed or interleaved wrapped), Alaska pollock blocks and fillets (the raw material for European fish fingers), Pacific cod fillets and loins, Pacific mackerel (whole round, headed & gutted, filleted). Chinese processing plants handle massive volumes of these species for European food service and retail.

Cephalopods: Spain, Italy, Portugal, these are the big European markets for squid and cuttlefish. Frozen Illex and Todarodes squid (whole cleaned or tubes and rings), frozen cuttlefish, frozen octopus. Chinese plants specialize in processing these for Mediterranean buyers.

Value-added products: Breaded fish portions, seafood mixes (shrimp + squid + mussels for retail "seafood cocktail" bags), prepared tilapia fillets with marinades or seasonings.

Transit Options and Realistic Timelines

Ocean freight (primary method):

From major Chinese ports, Shanghai, Ningbo, Qingdao, Shenzhen, to Northern European destinations like Rotterdam, Hamburg, or Antwerp, you're looking at 30-45 days port-to-port via Suez Canal. About 80% of China-Europe container traffic uses this route.

The Cape of Good Hope route (around southern Africa) takes 45-60 days. Carriers use it when Suez Canal faces congestion or geopolitical issues, but it's longer and generally more expensive.

Door-to-door timeline? Add 5-7 days on each end. Inland trucking from Chinese processing plant to port, container stuffing, port handling, then customs clearance at EU BCP, and final delivery to buyer's cold storage in Europe.

Rail freight (alternative):

The China-Europe Railway Express has expanded significantly over the past decade. Rail freight takes 14-20 days from Chinese cities to European destinations (Duisburg, Hamburg, and other rail hubs). Cost is roughly 50% higher than ocean freight but much faster.

We've used rail for clients who needed urgent inventory replenishment during European peak season (December holidays) when their frozen shrimp stock was running low. The premium was worth it to avoid stockouts.

Air freight for frozen (rare):

Air freight costs 5-10x more than ocean, so it's rarely used for frozen seafood. The only scenarios: emergency shipments to cover a buyer's production shortage, or ultra-premium frozen products (like high-grade tuna blocks) where time-to-market matters.

Chilled Seafood: Premium but Challenging

Chilled seafood from China to Europe is a specialized niche. Maybe 2-3% of total China-Europe seafood volume, if that. And most of the people who think they want to do it... shouldn't.

Temperature Requirements Are Unforgiving

EU Regulation 853/2004 states that "fresh fishery products, thawed unprocessed fishery products, and cooked and chilled products from crustaceans and molluscs, must be maintained at a temperature approaching that of melting ice." The industry interpretation: 0°C to +2°C maximum. Some buyers specify even tighter: 0°C to +1°C.

That narrow range is brutally difficult to maintain for 5-7 days (air freight door-to-door) or longer. Products are packed with ice, in insulated styrofoam containers, with gel packs, or in specialized refrigerated packaging. You add data loggers that record temperature every 15-30 minutes instead of hourly (like frozen) because there's zero tolerance for deviation.

If temperature hits +4°C for a few hours, bacterial growth accelerates dramatically. Shelf life shortens. If it hits +6°C, you're probably looking at spoilage by the time it reaches the European buyer.

Products Actually Suitable for Chilled from China

The list is very short:

Sashimi-grade tuna for high-end restaurants

Live shellfish (though these are tricky and have separate handling requirements)

Ultra-premium whole fish where "fresh" labeling creates major price differentiation

For standard commercial products, vannamei shrimp, tilapia fillets, squid tubes, pollock blocks, Pacific mackerel, chilled transport from China makes no economic sense. The cost doesn't justify the premium in European markets.

We had a client who wanted to ship live crabs to Spain via air freight. Specialized packaging, oxygen systems, temperature control, expedited handling at both ends. The economics barely worked even for premium live product. For anything less valuable, forget it.

The Practical Verdict for Seafood Shipping from China to Europe

Here's what we tell clients during initial consultation calls.

If you're shipping these products, go frozen: Vannamei shrimp in any format, tilapia fillets, Alaska pollock, cod, Pacific mackerel, squid tubes and rings, cuttlefish, octopus, breaded portions, seafood mixes, prepared products. Full container loads or LCL consolidations. Ocean freight in reefer containers at -18°C. This is where the infrastructure exists, where European buyers expect delivery, and where the economics work.

If you're considering chilled, answer these questions first:

Does your European buyer pay at least 3-4x the price of frozen equivalents?

Have they contractually committed to purchase at those prices?

Are you shipping premium products (sashimi tuna, live shellfish, ultra-premium whole fish)?

Can your volumes justify air freight costs?

If any answer is "no" or "maybe," stick with frozen.

Gray area scenarios:

Some products achieve premium pricing while still shipping frozen. Premium tuna blocks frozen at ultra-low temperatures (-60°C initially, then stored at -25°C), high-grade IQF squid, carefully processed shrimp, these can command better prices than commodity frozen without the complexity and cost of chilled transport.

Rail freight at 14-20 days offers a middle option for frozen cargo. If you need faster delivery than 30-45 day ocean freight but chilled doesn't make sense, rail might work. We've used it for clients managing seasonal demand spikes in Europe where paying 50% more for freight was justified by avoiding stockouts during peak retail periods.

How a Freight Forwarder Actually Helps You Decide

Experienced freight forwarders do more than book containers or air freight, they help you evaluate whether frozen or chilled shipping makes business sense for your specific situation.

Technical Assessment

Product suitability evaluation:

Review your seafood product against China-Europe logistics realities

Assess shelf life requirements versus realistic transit times

Evaluate whether "fresh" positioning justifies cost premiums in your target market

Recommend proven approaches for your product category

Cold chain capability audit:

Verify your Chinese supplier has proper facilities (blast freezers, cold storage, controlled stuffing areas)

Confirm supplier experience with EU export requirements

Assess whether infrastructure supports frozen, chilled, or both

Identify gaps before you commit to orders

Transit time vs shelf life matching:

Calculate realistic door-to-door timelines including potential delays

Compare against product shelf life with safety buffers

Flag scenarios where timing creates unacceptable risk

Suggest alternative approaches when primary plan has high failure risk

Cost-Benefit Analysis with Real Numbers

We run detailed cost comparisons for clients:

Frozen ocean scenario (from Shanghai to Rotterdam, 40' reefer container with 25,000 kg frozen shrimp):

Container booking: $2,800 (current rates vary seasonally)

Cold storage and handling in China: $300

Reefer premium over dry container: included in booking rate

Destination handling and BCP processing: $400

Insurance: $200

Inland transport to buyer: $350

Total: $4,050 for 25,000 kg = $0.16 per kg

Chilled air scenario (from Shanghai to Rotterdam, 1,000 kg chilled premium tuna):

Specialized packaging: $3,000

Air freight ($6/kg): $6,000

Airline handling fees: $500

Express customs clearance: $400

Refrigerated transport (both ends): $800

Insurance: $300

Total: $11,000 for 1,000 kg = $11 per kg

That's roughly 68 times higher per kilogram for chilled air versus frozen ocean. The European buyer needs to pay that much more, or close to it, just to make chilled economically viable.

Compliance Navigation

For both frozen and chilled, forwarders manage:

EU establishment list verification for your Chinese supplier

Health certificate coordination with Chinese authorities (GACC)

TRACES-NT submission and tracking

IUU documentation for wild-caught species (squid, mackerel, pollock)

Temperature monitoring equipment and documentation standards

Border Control Post clearance procedures

Risk Management

Container equipment issues:

Pre-inspect reefer containers for proper functioning

Quick equipment swaps if defects are found

Monitor reefer performance throughout transit with alert systems

Port congestion planning:

Track delays at major European ports

Suggest alternative routing when needed

Build buffer time into inventory planning

Seasonal rate management:

Help plan shipments around peak rate periods

Lock in contract rates for regular volumes

Advise on rate trends affecting budget planning

Gerudo Logistics: Expert Support for Your Cold Chain Shipping

Choosing between frozen and chilled seafood shipping from China to Europe requires understanding both Chinese export procedures and European import realities. Gerudo Logistics specializes in temperature-controlled cargo from China, with deep expertise in frozen seafood exports to European markets.

Our team helps you make the right mode decision by analyzing your product characteristics, target market requirements, and cost parameters. We manage the complete cold chain, from EU-approved Chinese processing plants through reefer container shipping and Border Control Post clearance to final delivery at European cold storage facilities.

Whether you're shipping frozen vannamei shrimp to Rotterdam or evaluating whether chilled delivery makes sense for premium products, we provide the analysis, documentation management, and operational support you need.

Contact us to discuss your specific seafood shipping requirements and get expert guidance on frozen versus chilled transport decisions.

Frequently Asked Questions to Ship Seafood From China to Europe

Should I ship my seafood from China to Europe frozen or chilled?

For 95% of commercial seafood (shrimp, tilapia, squid, pollock, mackerel), frozen reefer containers are the right choice. Chilled only makes sense for premium products where "fresh" status commands prices 3-4x higher than frozen, and only when volumes justify air freight costs.

How long does frozen seafood shipping take from China to Europe?

Ocean freight takes 30-45 days port-to-port, with total door-to-door timeline of 35-50 days including inland transport and customs. Rail freight offers 14-20 days at roughly 50% premium over ocean rates.

What temperature should frozen seafood be shipped at?

Frozen seafood must maintain core temperature at -18°C or colder throughout transport. Reefer containers are typically set between -18°C and -25°C depending on product, with continuous temperature monitoring required.

How much more expensive is chilled seafood shipping compared to frozen?

Air freight for chilled seafood costs 5-10x more per kilogram than frozen ocean freight. When you include specialized packaging, expedited handling, and faster customs clearance, total landed costs are dramatically higher.

Which Chinese ports are best for frozen seafood exports to Europe?

Major ports include Qingdao, Dalian, and Tianjin (northern China); Shanghai and Ningbo (Yangtze Delta); and Xiamen, Shenzhen, and Guangzhou (southern China). All offer established cold chain infrastructure and regular services to European destinations.

Can ocean freight work for chilled seafood from China to Europe?

Rarely. The 30-45 day ocean transit exceeds shelf life for most chilled seafood. Chilled ocean shipping exists only for very specific high-value products with extended chilled shelf life, using specialized vessels.

What products are best suited for chilled shipping from China to Europe?

Only premium items where "fresh, never frozen" justifies extreme cost premiums: sashimi-grade tuna, live shellfish, ultra-premium whole fish. Standard commercial products (shrimp, tilapia, squid) should ship frozen.

Conclusion: Make the Decision That Fits Your Business

Choosing between chilled and frozen shipping for seafood from China to Europe is fundamentally a business decision, not just a logistics choice. It affects your costs, risks, market positioning, and operational complexity.

Success requires:

Working with EU-approved Chinese suppliers who maintain proper cold chain standards

Understanding EU compliance

Partnering with freight forwarders who specialize in temperature-controlled seafood

Running honest cost analysis before committing to shipping modes

Ready to make the right choice for your seafood? Start by honestly assessing whether your product and market positioning justify chilled premiums, or whether frozen reefer shipping offers the economics and reliability your business needs. Work with forwarders who understand both modes and provide objective cost-benefit analysis.